Superannuation

The ultimate compounding interest for Australians.

Few people think about super and retirement until they need to. Then when they do, they wish they’d done something about it heaps earlier. There are a couple of really simple things you can do when you are younger which will see you in a couple of decades time saying “Geez I’m glad I did that!”

As superannuation is designed to be used in retirement, most young people never give it a thought. In many respects a set and forget approach may be justified, so long as it is set up correctly before you forget about it.

Superannuation is long term forced savings which provide money for you in retirement so you don’t have to rely on the age pension. For most of us, at retirement, it is likely to be the biggest investment we have. It is not a separate asset class itself, but a tax structure. Super is constantly going through changes because it is complex, especially the rules covering when and how you can access your super, and how it’s taxed.

If you are a federal or state public servant and a member of the PSS Defined Benefit (PSSdb) or Military Super schemes, there’s good and bad news. They are two of the best super schemes around and will be fantastic for your retirement, particularly if you stay a public servant for a long time. It’s only real downfall is that they are really, really complicated. The only way to get a handle on the basics of a defined benefit scheme is to get your info from the guys who run it. Understanding how it can work best for your situation is vital to gaining the most from it. And as public servants live on average one to two years longer than people in the private sector, they probably need to be getting the most out of it.

At last, a sign warning the unsuspecting tourists as to the origins of the building’s occupants.

These schemes are different to other superannuation including the newer PSS Accumulation Plan (PSSap) and they’re infinitely more complex, so get in touch with the experts at Commonwealth Superannuation Corporation.

The public service has actually had superannuation for a long time. The original CSS super was so good it cost the government too much money so they closed it to new members and opened up the PSSdb, which they eventually realised was too good as well, so they also closed it to new members. The PSSap was opened and eventually someone will realise that it too is a good scheme, and guess what will happen….

There are two types of superannuation schemes: accumulation schemes and defined benefit schemes. Time for another video.

Make sure your employer is putting at least 11% of your pay into a super fund, because by law they must do it if you are aged over 18, or aged under 18 and working over 30 hours a week. If you are casual, part-time or full-time and your employer is not paying super then you are being ripped off. If speaking to your boss doesn’t resolve the situation, dob the buggers in. As an employee, superannuation is part of your work contract which you are entitled to receive, so if you need to report your unpaid super, do it through the Australian Taxation Office.

If you reckon super is complicated now, it’s nothing compared to how complex things become when you retire. Age pension ages are increasing, the age at which you can access super is increasing, the age you get it tax free may be different to the age which you can access it, the age you can continue to contribute is limited, and, when you draw down a super pension, the minimum amount you can take out increases as you age. And that’s putting it simply! You may not need to worry about any of this crap now, but please tell older people you know who are affected by these things to seek independent financial advice.

Preservation

It is important for people of our age to understand that every dollar that now goes into super cannot be withdrawn from the superannuation environment until you are 60 years old. You can move it from one super fund to another, but it must be in superannuation. It’s a thing called preservation and it’s definitely worth remembering. There are a couple of exceptions to this preservation rule but you basically have to prove that you are completely stuffed financially, or that you are about to die, before you can get your hands on any superannuation money before retirement age. Anyone who tells you that, for a fee, they can get access to your super and pass it onto you, is probably about to rip you off.

So any decision you make to put any extra money into a super fund must take into consideration the fact that you will lock it away for a long time. Therefore, do not put any money into super that you will miss (especially if you are concerned that the many federal governments elected between now and your retirement will play with the super laws as much as those in the past have). Yes, putting extra money into superannuation is a great idea for your retirement, but for most people in generation Y it’s generally not seen as the number 1 priority – you can start to look seriously at this strategy when you hit your mid 30’s. As everyone’s situation is different it is very wise to get someone to go through personalised figures with you if you’re an older gen X, particularly if it becomes a question of putting extra into super vs paying more off the mortgage. People in younger generations who have written off ever being homeowners would be wise to consider putting extra into their superannuation to compensate for the situation where they will have to pay for rent in retirement out of their accumulated super.

There are two different limits to the amount you can put into super.

The first is a big amount: $110,000 of after tax dollars a year (or $330,000 in one go, then nothing for the next two years). That’s a fair bit of money and it’s a rule to allow small business owners to sell their business and put the proceeds into super (there are plenty of people who own a cafe who don’t put super aside for themselves – this measure makes up for that).

The second amount is much smaller: $27,500 of concessional contributions a year. These contributions are more complex due to the tax associated with it, but basically it includes the money your employer puts into super on your behalf, as well as money you salary sacrifice. So let’s say your employer contributes $10,000 a year, you can salary sacrifice up to a maximum of $17,500 for a total of $27,500 total. There’s a catch here and that is this money going into super is taxed at 15% on the way in, so don’t expect to see $27,500 increase in your super balance, it would increase by $23,375. If you haven’t gone anywhere near that $27,500 limit for years and, for example, find yourself getting a massive pay increase, you can top your super up to take advantage of any unused concessional contributions cap.

Yeah, we are hitting complex territory again, so this is the sort of thing you need to be getting financial advice on, but whatever you do, do not go over these two limits! Otherwise your super contributions will start being taxed at almost 50%.

For those who earn up to $43,445 and can find a spare grand to whack into super, the federal government will match your contribution up to $500. The amount of the government co-contribution tapers off until your income reaches $58,445 where it cuts out completely. To find out how much the government would add to your account if you add extra yourself, enter your income figures into this super co-contribution calculator.

Cartoon: Jenny Coopes.

I say you can only access your super at age 60 but I don’t know which year you were born in. If you were born after 30 June, 1964, you have to wait until age 60. If you were born before then, check out this table to see how old you have to be before you can get your super. Beyond 30 June 2024 the table below will no longer be relevant.

Superannuation Preservation Ages

Before 1 July 1960 55 years 1 July 1960 to 30 June 1961 56 years 1 July 1961 to 30 June 1962 57 years 1 July 1962 to 30 June 1963 58 years 1 July 1963 to 30 June 1964 59 years After 30 June 1964 60 years

Rolling it over

Many younger people have as many different super funds as they have had jobs, because every time they’ve changed jobs, their new employer has offered them a different super fund. Some of these funds may have only a couple of hundred dollars or less in them. Every old, inactive fund you have will be paying fees and some will be paying for life insurance as well. It is important to note that any life insurance you have with superannuation will probably only remain valid for a couple of weeks after you change jobs and your old employer has stopped contributing to that fund. Just because your life insurance would not be valid doesn’t necessarily mean the premiums stop being charged to your super account. Therefore it makes sense to have all of your super in one, or two funds at most, to save on the fees and get the most from the insurance. I say two funds because if you’re in a fund like a defined benefit scheme, you may decide that any non-defined benefit super you have would get a better return in an accumulation fund. And you never want to close a defined benefit fund without first getting personalised, independent financial advise.

Even if you decide not to roll all your super together, you need to make sure all your super funds have your Tax File Number to ensure you are not unfairly taxed.

It’s now super easy to combine all your super (pun intended) – all you need to do is login to your myGov account (the same myGov account you have for your tax, Centrelink, Medicare, etc.) where you can view all your super accounts and combine them into the one account. If you find that your myGov account doesn’t list all your super funds, ring the ATO or fill out the form at their Searching For Lost Super page.

Your name may only come up on the ATO’s search if you are a lost member. This can happen when you move home and don’t change your address with all your super funds. If the person who received your mail at your old house is kind enough to cross out your old address and return it to the sender marked “Not at this address” then you will be an official lost member. But if the person receiving your mail says “I don’t know who that person is” then throws it in the bin, the super company thinks you have still received the correspondence.

Or if you receive superannuation statements via email and you’ve changed email address the same sort of thing can happen.

It’s very important to check that any life insurance coverage you will get with the super fund you decide to choose is at least as good as the coverage in your old fund, otherwise you risk being underinsured. Life insurance may not be something that automatically comes to mind when thinking about super, but it’s definitely something to consider. Life insurance bought through superannuation can be significantly cheaper than when it’s purchased from a financial planner or insurance broker – anything up to one quarter the price for the same level of coverage. There’s more on life insurance in the Insurance topic.

Sorry, but now you know how simple it is, I leave you with no excuse for not rolling over all your little super accounts into one. Once you have those funds together you might get a pleasant surprise from seeing one decent amount.

Please don’t put off combining your super. Australians pay many millions of dollars a year in unnecessary superannuation fees due to the fact that there are almost three super accounts for every working person. Make sure you rightfully claim your piece of the $16+ billion that’s currently in unclaimed super.

Once all your super is in the one place, when you change employers, take your super with you. You don’t change bank accounts when you change jobs, so why should your super be any different?

Cartoon: Jenny Coopes.

Industry vs retail

But which fund should you have your super in? Many of us can choose which superannuation fund our employer is to put money into. If your employer allows it, nominate the fund by filling out the Standard choice form.

There are two main types of accumulation super funds: industry funds and retail funds. Industry funds are generally run by unions and include such funds as Australian Super, CBus and Host Plus. These funds have low levels of fees and do not pay commissions to financial planners. They are generally not-for-profit as all profits are designed to go back to the super fund member. The other type of fund is a retail fund and includes any type of super offered by the banks, AMP, Colonial First State, Perpetual, Macquarie or any other commercial fund manager. The fees they charge are higher than for industry funds as they are designed first and foremost to make a profit for themselves.

One tool to help you compare an industry to a retail fund is SuperRatings’ Fund Comparator on the Industry SuperFunds website. *Note* – Yes, it is in the interest of Industry SuperFunds to have a comparator that shows their funds in a good light. No, I do not have any reason to doubt the accuracy of SuperRatings’ information. If you use that comparator, you will see that the industry funds score well for their low fees, which, over the long term, can mean a significant amount more money in your fund. But how do the average returns of retail and industry funds compare?

Surprisingly, the industry funds have consistently outperformed their retail counterparts over the long term, on average. And generally, despite their good performances, industry funds are not recommended by financial planners.

This table on the left shows the top 10 balanced funds returns over a five year period to the end of 2006.

Source: Sydney Morning Herald, 18/04/07

The balanced option of super funds is the default option and where more than 80% of Australians’ super money is invested. Eight of the top 10 are industry funds. By the end of 2008, all the top 10 balanced fund returns over a five year period were industry super funds. To 2015, industry funds had an average 10 year return 2.21% higher than retail funds. The out performance remains consistently in the favour of industry funds.

However, there are still a few retail funds that have achieved good returns over the long term which would more than compensate for their higher fees. So, all I have been able to do is confuse the hell out of you. If you don’t want to do the research to find the very best fund for you and just want a fund that will (based on past data) have lower average fees and higher average performance, then you are better off going for an industry fund. For more on industry funds visit Industry SuperFunds.

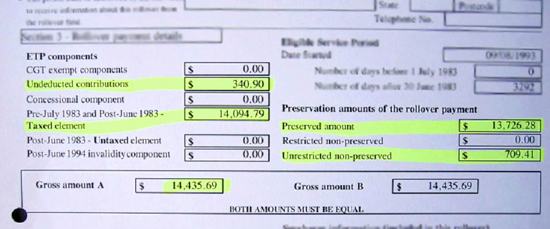

Super statements

There is a lot of information on a super statement and usually not a lot of simple explanation. The bits highlighted in the statement on the right are the most important and most common for people in our age groups.

The total amount in this account is $14,435. This amount will be treated for tax purposes in two different ways (looking at the information on the left hand side). The undeducted contributions of $340 (now known as non-concessional) is money which this account holder would have put into super out of their bank account. This is not part of your normal super contributions that your employer makes for you each pay and it is also not part of salary sacrificed contributions. The undeducted contributions are not taxed on the way into or out of super. The taxed element of $14,094 is what the employer has put in. It was taxed on the way in but it will not be taxed on the way out after the person has retired at age 60. *Note* Those earning under $37,000 still have tax taken out of their super as it goes in (from your employer, your own salary sacrificed contributions and any that you are able to claim a tax deduction on yourself if you are self employed). But come the end of the financial year you will get up to a $500 bonus in your super automatically after you have done your tax. It makes the system fairer for low income earners by effectively refunding the tax that’s automatically taken out of money going into super.

The preservation parts (on the right hand side) tell you when you are allowed to access your superannuation. As I stated earlier, all money that now goes into super will be like the amount of $13,726 – preserved, unable to be taken out of the super environment and spent by the account holder until they reach age 60. If you are a bit older, you may have a small amount of unrestricted non-preserved, in this case $709, which can be taken out and spent at any time (subject to taxation of course). If you do have any money in this category, unless you are in absolute dire straits financially, you should just leave it there until you retire.

Risk and return

What sort of investment risk should you have your super in? Anyone aged from 18 to 50 has between 10 and 42 years their super must be invested, unable to be touched. In investment terms, this is between a long time and a hell of a long time. We know that growth assets of property and shares are best kept for seven years or more. Therefore if you have more than seven years until you retire, you should give very serious consideration to putting your super into funds invested in property and shares and leaving it there over the long term. Put simply, younger people can afford to be more aggressive with their super investments.

Source: The Australian, 04/11/09

Because super funds are basically the same as managed funds, the investment options for superannuation are very similar to those for managed funds. If you keep your super in low risk/low return funds over 10+ years you will be potentially missing out on hundreds of thousands of dollars.

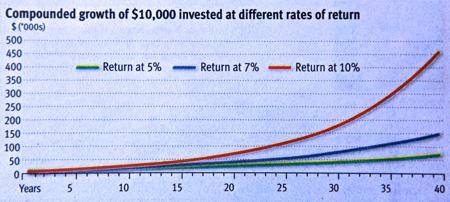

Take a look at this graph on the right. It’s only an example, but a pretty stark one. A 5% return is what you could expect from cash and fixed interest assets (a managed fund might call it capital stable or capital guaranteed). Balanced funds will return around 7%, and growth funds are the ones likely to give returns closest to the 10% line over that 40 year period.

If the different terms like balanced, conservative, defensive and growth are confusing for you, you’re not alone. Recent changes to super mean that a standardised risk description must appear with super investment options. This makes it much easier to see straight away that funds in band 1 are very low risk, band 2 is low risk, band 3 is low to medium, 4 is medium risk, 5 is medium to high, 6 is high and 7 is very high risk. You read that right: band 7 offers the highest return – the one where your money should sit for a long time.

Want to see for yourself? Play around with a few scenarios on this super projection calculator, including punching in your own figures and risk/return level. Then see what the figures are like when you change your levels of risk and return. You might find the results quite striking.

Any inactive fund of yours that you have yet to rollover into your current active fund will probably be automatically invested in cash and fixed interest, the worst of these funds offer returns of a whopping 0%, and some have fees as high as 5% of the balance. Yes, your super will go up and down a lot more if it is invested in growth assets than if it’s in cash and fixed interest, but history has shown that growth assets always outperform less risky ones over the long term.

Because we cannot access our super for so long it shouldn’t matter to us how volatile it is over the coming decades. It only matters how much is in your account when you get closer to retirement. So if you choose the highest risk option for your super until you are within about seven years of retirement, you should gradually reduce your exposure to growth assets the nearer you get to finishing work.

So how much super will you need? It depends on what sort of lifestyle you want and whether you are single or not, but to give you an idea Super Guru has figures that are updated quarterly and an explanation of their breakdown. They take their figures from ASFA, the Association of Superannuation Funds of Australia, who, let’s face it, probably have a vested interest in encouraging people to put as much money into super as possible. A group who don’t have a vested interest in their retirement target figures is Super Consumers Australia. Their savings targets are lower. What you will need in retirement may be somewhere in between the figures these two sites spit out.

The feet of my niece, Charlotte, aged 10 weeks.

Stuff about money is generally the same no matter whether you are a guy or a girl, with a couple of exceptions. One of those is with super. Women don’t earn as much as men so therefore will have less super being put away by their employers. Australian women are paid around 86% of what men are paid for similar work and will earn around $1 million less than a man over the course of her career. Women tend to have more time out of the workforce than men do (usually baby-related breaks), for up to quite a few years, with little or no money going into super. At retirement the average woman currently has half the money in super that the average man has but women live longer, so have to survive for longer on less. Ladies, the only good thing is that your male partner will probably die before you, and you will (hopefully) get what’s left. If you don’t have a male partner or significant money in super, you may be screwed.

FURTHER READING: My Money, Myself by Anne Ingram & Peggy O’Donnell: Written specifically for women, this is a short and easy to read book. It’s no longer in print so check out availability at your local library.

FURTHER READING: My Money, Myself by Anne Ingram & Peggy O’Donnell: Written specifically for women, this is a short and easy to read book. It’s no longer in print so check out availability at your local library.

Self-Managed Super

Self-Managed Superannuation Funds (SMSF or DIY funds as they are also known) are growing in popularity as well as size in terms of the money they hold. As the name suggests, an SMSF is where you can have pretty much total control over your super, and they are being pushed by a lot of people in the financial advice industry (it’s probably no surprise to you that advisors stand to make large amounts of money with SMSFs). Like anything finance related, there are a bunch of pros and cons with SMSFs that you need to know before you flirt with the idea of getting one for yourself.

First the case for the affirmative: SMSFs allow great flexibility and control. As an SMSF member, you are trustee of it, as are up to three other fund members (every member must also be a trustee). You can invest in direct property and, unlike normal super, SMSFs allow you to invest borrowed funds. They can be cheaper to run than an ordinary retail or industry super fund and their flexibility extends into the phase where they start paying a pension to you or a dependent on your death.

Now the negatives: They’re so complicated they make ordinary super look like child’s play. You can set one up without being an expert in investment, taxation, estate planning, superannuation law and insurance, but you’ll need to pay people who specialise in these areas to do it right. Even well qualified specialists struggle to keep up with all the legislation that governs them. Every year you have to lodge tax returns and have your SMSF audited. Taking into account the annual costs of compliance to make setting one up worthwhile, you need to have a minimum balance of around $300,000. [That $300,000 figure doesn’t mean you can have $50,000 in super then borrow another $250,000 to purchase a property for your SMSF, I’m talking $300,000 as a starting balance transferred from a retail or industry fund. There is a growing market in real estate selling inflated properties to SMSF holders, complete with things like “guaranteed rental returns for two years!” As I stated in the Investment topic, guaranteed rental returns are just a way of selling real estate at inflated prices.] If someone rips you off (yep, there are plenty of scammers targeting SMSFs) you’re on your own, and getting compliance issues wrong can mean losing huge amounts of your super in tax. The life insurance attached to them is generally more expensive than life insurance taken out through large super funds and you may have to undertake a medical examination to get it (which you usually don’t need for insurance through industry/retail super funds).

In summary, you can go it alone and try to out-perform the markets. Or you can relax and leave all that stuff to people whose job it is to handle all the boring crap. I don’t have one, nor do I have any desire to ever set one up. I’d rather spend the time it takes to run a Self-Managed Super Fund with my kids. It’s not just me who says this sort of stuff. The ATO’s Deputy Commissioner for super reckons for a Self-Managed Super Fund to be run successfully “they require significant time, attention and expertise.”

Due to the growing numbers of people pulling their money out of traditional super funds and putting the money into their own SMSF, the big super funds are increasingly looking at products that can convince people to stay. They go by various names but all allow greater flexibility to super members in terms of their investment options. Most allow members to pick shares from the ASX 200, ETFs as well as term deposits. However they do not allow investment into direct properties where ordinary SMSFs do. They sit in between ordinary super and an SMSF in terms of cost, flexibility, complexity and the amount needed to start one, and may be a suitable stepping stone to a full SMSF if that’s what you later decide. Check with your current fund if it offers this option.

To sum up the topic of superannuation: for most of us gen X and Y people, super can be more or less ‘set and forget’ for quite a few years. Roll all your small funds into one remembering that you may now have the choice as to which fund your employer contributions go into. Seriously think about choosing the growth asset option if you want a decent amount of money by the time you retire. If you want to put extra money into your super, get independent advice.

Superannuation Questions

1) The age at which you can access all your superannuation money is currently:

- The age you decide to retire

- Between 55 and 60, depending on the year you were born

- 65

- 67

- 70

- The key word in this question is currently. By the time we gen X and Ys reach age 60, the preservation age (when you get your super) will probably be higher. If you were born in the 70’s, 80’s or 90’s, you don’t need to be aged 60 when you retire, you can retire whenever you want. You just need enough money to live on if you want to retire before you can get your super. So, for example, if were born on Oct 26, 1981, you had made enough money already and your name was Guy Sebastian, then you could stop singing immediately and retire. Please Guy, stop singing.

2) Which of the following investment options would see your super return the highest amounts over 25+ years?

- Cash (band 1)

- Capital stable (band 2)

- Balanced (band 4)

- Growth (band 6)

- High growth (band 7)

3) What is the minimum amount you should have in super before you consider setting up a Self-Managed Superannuation Fund?

- There is no minimum

- $100,000

- $200,000

- $300,000

- $400,000 or more

Superannuation Resources

- Commonwealth Superannuation Corporation

- Report unpaid super

- Super co-contribution calculator

- myGov combine super

- Search for lost super

- Superannuation choice form

- SuperRatings’ Fund Comparator

- Industry SuperFunds

- Super projection calculator

- How much super will I need?

- How much super will I really need?

- My Money Myself by Anne Ingram & Peggy O’Donnell