The Early Years (0-5)

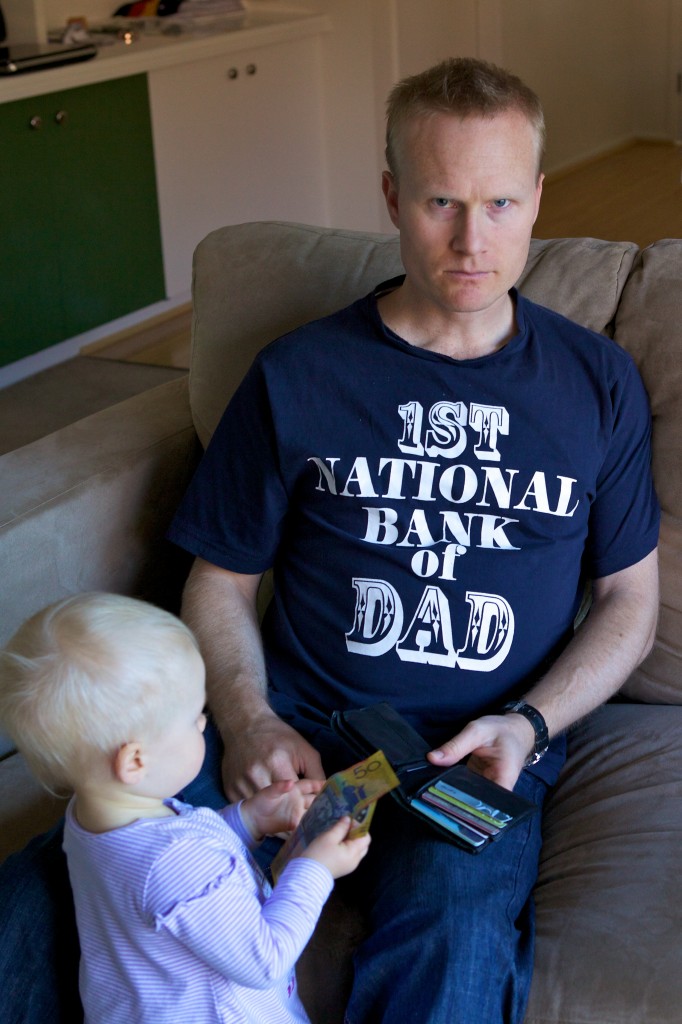

Teaching young kids about money needn’t involve creating Excel spreadsheets and calculating foreign tax credits. After all, you do want to try to make it interesting.

As soon as children are old enough to know what going to the shop means, they are old enough to start playing the game with you. To allow your child to comprehend exchanging goods for money all you need is a bench, some ‘money’, some teddies to buy and your child opposite you in the ‘shop’. When they are old enough you can use real coins, explaining that the largest ones are not worth the most.

The concept of money should be introduced to children from very early so that it is ingrained in them. A really great way of doing this is to show them in practice how compound interest works. Setting up an investment for your child doesn’t need to involve large sums of money or complicated strategies. So long as interest is being earned on interest, and the child can see this happening, you have the foundations your kids need to understand this most important part of financial management.

Case Study

My earliest memories of money (apart from listening to ABBA’s Money, Money, Money on LP) was gained from my great-grandfather. When Papa was about 90 he must’ve realised that he didn’t have long to go and he made the very wise decision to give some money to each of his great-grandchildren.

My great-grandfather was a pretty cool bloke. He even built a church in his spare time – that photo is of the stained glass window that’s above the front door. The guy on the left is Papa, kneeling before the Lord, who Himself appears to be looking over the blueprints. Jesus really rode Papa over the whole build, just like the foreman who rides contestants on The Block. Typical perfectionist carpenter.

When I was very young (about 4) Papa gave $200 to each of his great grandchildren, of which I am one of the youngest. I’m pretty sure that some of the older recipients spent that money on roller skates and Rubik’s Cubes, but my two siblings and myself didn’t. Not because we’re tight, but because we didn’t get to see the cash. On our behalf, my old man wisely put the money into a debenture until we turned 18 (for more on debentures and other fixed interest investments, see the Investment topic).

My sister was the first to turn 18 and one-third of the money was withdrawn and given to her. A couple of years later my brother turned 18 and he received half of the remaining balance. By the time I was old enough, compound interest had worked its magic.

I received just over $800. I could not believe it! Eight hundred bucks was an enormous amount of money, especially as I thought for years that we had received only $100 each, not $200. But even better than the cash was the lesson I had learned about compounding. It was the single greatest lesson on money I have ever had – passed on to me from a man I hardly remember, and concreted by my father’s wise decision.

In turn, my wife and I put aside some money on the birth of our children, which we’ll tell them about as they grow older. Once every couple of years they can see the balance (which hopefully will have grown in between), then receive the proceeds around their 18th birthdays. It might just be the best financial lesson they get too.

Investments

Even before your children receive their first dollar, swallow it and end up in the emergency department of your nearest hospital, you may be inclined to get things started for them. This may take the form of something simple like a bank account, or more complicated such as superannuation or a managed fund, shares or an investment bond. Without going over all the pros and cons for investments again (if you skipped the Investment topic, now is a good time to go back and read it) it’s worthwhile looking at these investments from the point of view of a child and parent.

Many parents who look to invest money for their young children’s future will weigh up putting money into an investment versus putting that money into their own mortgage as extra repayments. Ignoring the fantastic lessons that children can gain from being involved with an investment in their name and focusing purely on what may be the best return for you, you may need to sit down and crunch a few figures if you have a mortgage and are weighing up making extra repayments into it versus investing in growth assets. If your choice is limited to extra repayments versus saving in a bank account or term deposit, the extra repayments win every time because the interest you pay on the mortgage will always be higher than the interest rate your savings will earn. Once the mortgage is out of the way you will have spare cash to set aside for things like your kids’ education, assuming you are still disciplined enough to save after the home is paid off. Any value in the financial lesson for your children of extra repayments depends on the level of involvement and understanding that they have with the mortgage. I’m not saying you should get them to work and contribute to paying off the mortgage with their pocket money, just consider telling them the basics of how you had to borrow to buy your home and that every little bit of saving helps to pay it off.

Bank accounts

Bank accounts are simple and therefore easy for young children to understand. They can see the physical money being handed over to a teller and relate that to the numbers going up in their account. They are also relatively easy to open. However, due to the fact they offer no capital growth, they are not suitable as long term investment vehicles. Bank accounts are perfect for small amounts of money, but for a longer term investment of five years plus to be used for school or university fees, there are better places to put your money. Some banks will automatically transfer money across to the adult version of their child accounts when the child reaches the maximum permissible age. This age will differ from one bank to another but can be as young as 12 or as old as 21.

Bank accounts for kids tend to come in three forms. There are fee-free child versions of a bank’s normal transaction account that will likely have interest rates that match their fees, traditional children’s accounts designed to encourage regular deposits with decent bonus interest, and online versions of these higher interest rate accounts. Opening an online bank account usually means you have to have funds in a traditional account and transfer them from there. Online accounts offer a good way to introduce children to basic concepts of online security.

Whichever you choose, the perfect bank account would have a good interest rate, no fees, interest calculated daily and paid monthly, bonus interest for deposits and no withdrawals, and no minimum balance or minimum deposit amounts. Good luck finding an account that ticks all those boxes, but the more ticks the merrier.

If a child earns more than $420 interest a year and has not provided their bank with their Tax File Number (or more than $120 if they have not provided their date of birth) the bank must withhold tax of 47%. For details on who has to declare income on the interest of bank accounts see the ATO’s site, and for more on children’s tax rates, see below.

Years ago the CBA’s passbooks looked

like this, which is not exactly appealing

to a young audience. I know, ‘cause

after they updated them I decided I

didn’t like mine and threw it in the bin

so I could get a new funky looking one.

It is the only thing related to finance I

have ever thrown away.

Photo credit – Flickr

Many schools used to participate in the Commonwealth Bank’s School Banking Program where kids could deposit weekly money at school. I clearly remember depositing 50 cents into my first CBA passbook on a regular basis in the early 1980s, when the bank was still publicly owned. From a marketing point of view, it was a really good idea for the Commonwealth Bank to get as many young account holders as they can thinking of their brand on a weekly basis from their first year of primary school. But it came at a price. Schools who participated got kickbacks dependent on how many kids participated. Children who participated received comparatively low rates of interest, starting at around 0.5%pa and earned toys for making deposits. According to Choice “Rewarding children for saving with cheap toys easily transitions to rewarding young adults with “special” offers of high-interest personal loans and credit cards.” The program was

easy, convenient and it promoted saving. But it was also something you can do yourself, with better interest, from a better institution.

Due to a backlash against school banking programs (Barefoot Investor Scott Pape likened the CBA teaching kids about money to Ronald McDonald teaching our children about nutrition), the CBA closed their program in 2021.

There’s no reason an older child couldn’t set up more than one bank account in the same way as an adult’s finances may be organised. One account with a decent interest rate can be for goals down the track while another with easy access (and probably lower interest rate) is used for more regular purposes.

Whichever type of investment vehicle you decide is best for your child, it’s a really great idea to print paper statements from the provider, especially if the child’s regular savings will appear on them. Children will be able to understand the importance of saving much better if they can see on paper the starting balance and the way that balance changes as the savings grow. As the child grows they will be able to better understand digital statements.

Shares

Some companies allow minors to own their shares, while other companies do not. Try as I might, I have been unable to find lists of companies whose constitutions do and do not allow children to be shareholders. If you wish to have a share portfolio for your child, the independently owned company Market Index recommends the parent or guardian holds them in their name, with an account designation in the child’s name. For more, read up at Market Index. Legally, these shares will be the property of the adult and taxed in the adult’s hands at the adult’s marginal rate. So it makes sense from a tax point of view for the parent with the lowest marginal tax rate to hold them. When the child reaches 18 they should be allowed to receive the transfer of the shares without capital gains tax implications. For details on who has to declare income on share dividends see the ATO’s site. And don’t ignore the need to make sure you have adequately diversified the money invested in their name – not an easy feat with a small amount of money invested in individual shares but simple when invested in an index fund (for more on those, see the Investment topic).

A good way to introduce your teenage kids to the sharemarket is via the ASX Schools Sharemarket Game, or you can have a crack at it yourself in the adult version, which is found on the same page.

Family trusts

As a child can’t legally enter into a contract, they can’t legally hold property directly. You would also be flat out finding anyone that would lend a child money for a house. Holding managed funds directly in the name of a child is either not allowed or just too bloody hard for most people wanting something simple.

However, it is possible to hold property, managed funds, shares and just about anything you could think of, through a family trust. This is not something you want to enter into lightly, and you really need to get independent legal and tax advice before you start one. Family trusts need to submit annual tax returns too, which, unless you are an accountant, is not something you want to be doing yourself.

The advantage of a family trust is that the trustee can distribute any income the trust makes to the beneficiaries as they wish. In effect, this means that family members on the lowest tax rates can receive the trust income so that there is little or no tax paid. The right trust set up in the right way and administered properly can be a great tax planning tool and is also very flexible for holding investments designed to look after your kids’ futures.

The downside to family trusts was experienced by Australia’s richest person (who is also one of the world’s richest woman) – Gina Rinehart. Once the money is in a trust it is owned by the trust, not an individual, which means the control of the money is different to holding investments in somebody’s name. If your family ends up loving each other like Gina’s does, you’d better like spending time in court. The implications for capital gains tax can be complicated with family trusts, and the tax office may not look favourably on your trust’s tax return if they feel you have only set it up to avoid tax. A key point the ATO looks for with the income distributed from family trusts is whether the person stated in the tax return as having received the trust’s income has actually been given that money. Family trusts only remain effective tools for as long as the laws that govern them are not changed to make them undesirable.

Forget about setting up a scholarship fund for your child’s tertiary education expenses. I hope you are not reading this after starting one a number of years ago, ‘cause you’re probably gonna spew, especially if it was with Australian Scholarship Group. For every good story about them, parents have ten bad experiences. There are many problems that people complain about with scholarship funds, but most are about their returns being way below what was originally calculated and that they are inflexible. If you can guarantee that your six month old child will eventually go on to university after completing school, a scholarship fund might be suitable. But if your child does a two year TAFE course, takes more than 12 months gap between school and tertiary study, takes a gap year with a lower year 12 score than other scholarship recipients, undertakes less than 20 hours/week university or TAFE study, or decides part way through their degree to change courses, there are likely to be large penalties.

Scholarship funds and other education savings plans will hit you with penalty tax rates if the money withdrawn is not used for eligible educational purposes.

*Note* Scholarship funds where the parents/grandparents set up and provide the funds should not be confused with scholarships offered by secondary and tertiary institutions. Scholarships that are granted or won do not require you to provide upfront or ongoing money, but there are relatively few of them and they are difficult to win.

Investment bonds

Probably the best investment for someone who has young children is an investment bond, also called insurance bonds. Please don’t confuse investment/insurance bonds with government bonds as they are completely different (see the Investment topic for more on government bonds).

Cartoon courtesy of Michael Mucci

An investment bond is a relatively complicated type of investment. The way they work is as follows:

- You decide what mix of investments will be suitable for the timeframe you are investing for (remembering that the higher the expected return, the greater the risk, and that growth assets like property and shares are likely to outperform over periods of 5+ years).

- You make an initial investment (which is subject to a minimum amount, like $1,000).

- You can choose whether to add regular monthly amounts (again, subject to minimums, like $100 per month) or to add a lump sum to the investment bond every year. You must contribute some money every year to retain the tax effective status of the investment bond.

- If you decide to increase the amount you contribute, it must not be greater than 125% of the amount you contributed in the previous year. If it is more, the fund loses its tax effective status.

- All income the investment bond makes is taxed within the fund. This means you do not have to include any income or any figures at all in a tax return.

- The income the fund earns is taxed at a maximum of 30%. You can effectively lower this rate by choosing an investment mix that is made up of a large percentage of Australian shares. The shares that pay franked dividends will lower the tax that the investment bond is hit with.

- After 10 years, the proceeds can be paid out tax free, meaning you would pay no capital gains tax on the increase in value of the investment bond. Yep, you read that correctly; so long as you don’t break the rules when you put money in every year, no income tax and no capital gains tax is payable by you when an investment bond is held for a decade.

- Investment bonds can be held for a maximum of 40 years.

- Investment bonds will usually have an element of life insurance attached to them, the details of which will vary from one provider to another, which is why they are also called insurance bonds.

Sound pretty good? Here’s the catch. If you are looking at an investment timeframe of less than 10 years you will be stung with some pretty hefty tax. If you accidentally forget to put money in it one year, or if you contribute more than 125% of what you put in last year, your 10 year time frame starts over.

Investment bonds are best suited for people on middle and high marginal tax rates (32.5%, 37% or 45%) as tax is paid on income at a maximum of 30%. If your marginal rate is over 30%, the investment bond would pay less tax than you could if you put your money in the same assets outside of that investment bond. They should, however, only ever be used over a minimum 10 year time period. So if you want to set one up to pay university fees for your offspring, you need to get your act together before their 8th birthday. Unless your kid is one of those geniuses, in which case you need to set one up before they turn four.

Whichever investment you decide to invest in on behalf of your child, you must remember the rules of risk and return. The greater the risk, the greater the expected return (again, if you skipped it, go back and read through the Investment topic, as understanding risk and return is particularly important).

You must also understand that the person you are investing for may have a different risk profile to yourself. For example, if you are way too nervous to ever buy shares because they go up and down too much for you to handle, and you would need to use the money you wish to invest two years from now, your risk profile would be that of a conservative investor. Investing in shares for your six month old, to be used for tertiary education is a different story. They will only be able to receive the money at age 17 or 18 at the earliest, and they will not watch daily finance reports to see their investment drop by 1% today and rise by 0.5% tomorrow. In essence, your baby would have a risk profile of an aggressive investor.

Conversely, if you are thinking it’s a good idea to invest in shares as a 15th birthday present for your son, to ultimately give to him to spend on his last day of year 12, even if you have experienced a good run with shares yourself, your son’s three year investment time horizon means that the only appropriate investments are cash and fixed interest. If this is starting to make you feel like you did when your year 10 science teacher first mentioned the fundamentals of quantum physics, it’s time you engaged the help of a professional (see the Financial Planners topic for more).

Tax File Numbers

On second thoughts, you should fill in the paperwork for them.

According to the Australian Taxation Office, a child can get a Tax File Number (TFN) at any age, and they are not exempt from quoting one. Yes, things can get complicated from a very young age. Get the child to fill in the paperwork themselves, I say.

Getting a TFN for a child is a piece of cake if:

a) You studied taxation law;

b) You live in close proximity to the CBD of a capital city; and

c) You work at the ATO

On the off chance you don’t fit into all these three categories, getting a TFN for your young child will be a pain in the arse, but the best way of looking at it is to remember that you only need to do it once in a lifetime. The ATO has only 22 locations around the country, and they don’t all provide full services. Pretty incredible when you consider they employ 20,000 people. Luckily you can apply through Australia Post and Centrelink offices. To apply for a Tax File Number on behalf of a child, start your journey at the Australian Taxation Office website.

Tax rates

In the Taxation topic, I briefly mentioned that children can pay extraordinarily high amounts of tax, depending on the source of their income. Children who work part time, full time or casual will pay tax at the same rates as an adult on money from these sources. Income that is coming from investments, royalties and discretionary trusts (or as the tax office calls it, unearned income) can be hit with higher marginal rates of tax than anybody else in society. As with all things tax, there are some exceptions. Generally, children who are disabled and receive a pension associated with their disability, or who receive money from a deceased estate, will have all their income subjected to the same rates as adults. That’s both earned income from their work and unearned income from investments. This is known as excepted income.

The following table shows the different rates of tax on kids.

Children’s Tax Rates

Amount Tax Rate

0 – $416 Nil

$417 – $1,307 Nil + 66% of the amount over $416

Over $1,307 45% of the total income that is not excepted income

Children are not eligible to receive the low income tax offset on income from investments.

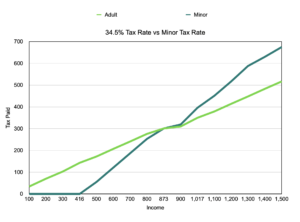

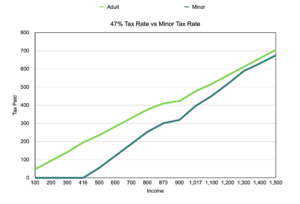

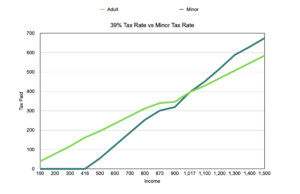

Just because children can pay tax at rates as high as 66% doesn’t automatically mean that any investment would be better placed being taxed in the hands of an adult, whose marginal rates of zero, 21%, 34.5%, 39% and 47% are all considerably lower than 66%. I’m about to get heavy, so stand up and stretch if you need to before taking a look at that complex table below.

Whether the chosen investment may be better for tax reasons in an adult’s or a child’s name depends on how much income your child’s investment is earning and what the adult’s marginal tax rate is. As children pay no tax on investment income up to $416, investments earning under this amount are always better held for tax purposes in the child’s name (or an adult in the 0% marginal tax rate, ’cause either way you pay no tax). Beyond $416 per annum income there are cut-off points. The table below attempts to show in as simple terms as possible what the cut off points are for investments earning between $416 and $1,500 a year. By cut off, I’m referring to the point at which the investment is better held in the name of the parent.

As you can see, where a parent earns in the zero marginal tax rate, the investment is always better being taxed in the adult’s name regardless of income. If it’s a choice between holding an investment in the name of an adult earning in the 21% marginal tax rate or in the name of a child, it’s a little bit complicated because of where the Low Income Tax Offset kicks in. However, for investment income amounts up to $1,500 (as shown in the graph below) you will pay no tax if an investment is held in the adult’s name. If it is a choice between a child and an adult earning in the 34.5% marginal rate, investments earning up to $873 a year are better held in the child’s name. Beyond $873 p.a. income with an adult in the 34.5% marginal rate it’s better being held in the adult’s name. For the 39% marginal rate the income cut-off is $1,017; below $1,017 p.a. income, hold it in the kid’s name, above $1,017 hold it in the adult’s. And a taxpayer in the top marginal tax rate of 47% will always pay more tax on investments than a child would.

Comparison of tax payable on various investment income amounts between adult marginal tax rates and children’s tax rates, cut-off points in bold.

| Income | 0% | 21% | 34.5% | 39% | 47% | Child (45%) |

|---|---|---|---|---|---|---|

| 100 | 0 | 0 | 34 | 39 | 47 | 0 |

| 200 | 0 | 0 | 70 | 78 | 94 | 0 |

| 300 | 0 | 0 | 103 | 117 | 141 | 0 |

| 416 | 0 | 0 | 143 | 162 | 195 | 0 |

| 500 | 0 | 0 | 172 | 195 | 235 | 55 |

| 600 | 0 | 0 | 207 | 234 | 282 | 121 |

| 700 | 0 | 0 | 241 | 273 | 329 | 187 |

| 800 | 0 | 0 | 276 | 312 | 376 | 253 |

| 873 | 0 | 0 | 301 | 340 | 410 | 301 |

| 900 | 0 | 0 | 310 | 346 | 423 | 319 |

| 1,017 | 0 | 0 | 350 | 396 | 477 | 396 |

| 1,100 | 0 | 0 | 379 | 429 | 517 | 451 |

| 1,200 | 0 | 0 | 414 | 468 | 564 | 517 |

| 1,300 | 0 | 0 | 448 | 507 | 611 | 588 |

| 1,400 | 0 | 0 | 483 | 546 | 658 | 630 |

| 1,500 | 0 | 0 | 517 | 585 | 705 | 675 |

This table assumes the adult taxpayer is not pushed up into the next marginal tax rate and amounts include the 2% Medicare Levy for all rates other than zero and the children’s tax rate. Also assumed is that the taxpayer in the 21% marginal rate is receiving the full Low Income Tax Offset. The table does not take into account any other income earned by the adult. So, for example, the 21% taxpayer who is earning closer to the cut-off for the 34.5% marginal rate would actually pay some tax on these investment earnings, however an investment in the name of an adult in the 21% marginal rate will always be better held in the name of the adult.

Yeah, I admit that table can be a bit much to grapple, so to make it simpler the following graphs directly compare the children’s tax rate with the 34.5%, 39% and 47% adult marginal rates. Where the dark green line of the minor remains below the light green line of the adult it indicates a lower amount of tax paid by children.

If you thought tax was a complicated area, it’s nothing compared to families.

With an enormous number of children no longer living in the old fashioned mum, dad and their two kids nuclear family, there are a correspondingly high number of families whose lives are affected by child support. Generally, people will either be entitled to receive child support, obliged to pay it or sometimes even both.

If you have recently or are about to separate from your child/children’s other parent and want to get a rough idea of what your child support situation will be, go to the Child Support Agency estimator. There is a lot of fine print for this website, including its inability to calculate child support in complex situations.

Care Arrangements

There are a few options available for placing your children in care while you are at work or studying. The best option is probably to leave them at Grandma and Grandpa’s house. The kids will be in a familiar environment and the costs to you, if any, will be pretty low. If that particular luxury is not an option, your choices include child care, family day care, pre-school, nannies or an au pair.

Child care

A child care centre (also called long day care) is a place where as many as 100 or more children attend, from newborns through to about five years old, and it is a very popular option for working parents. Some child care centres offer before and after school care for primary school kids as well, typically 07:00 – 09:00 and 15:00 – 18:00. Most centres are open from early morning to early evening, Monday to Friday, and they generally charge a daily rate regardless of how long your child attends during any one day. Fees can be anywhere from about $70 – $170+ per child per day and rising, although in many cases the government offers a rebate and a benefit where eligible (see below). You won’t get a rebate for any fee they might charge you to get on their waiting lists though. Some child care centres provide food while others stipulate that you have to provide your own. They are run by (mostly) competent, trained staff who care for and educate the kids and help them to play and develop.

Getting a spot in a child care centre can be a nightmare for parents as many are full and will only offer places when children drop out. Too many seem to ignore their waiting lists and will offer a place to the parent who continually rings to ask if a spot has come up, or the next lucky parent to walk through the door when a vacancy has just become available. A common complaint about child care centres is that their costs are so high that the parent who drops their child there in the morning has only just made enough money at work by the time they pick them up to pay for that day’s fees. Kids who attend child care will usually develop good social skills, but they’ll get every bug known to science in the process (and even some your doctor won’t know).

If you or your kids are crook often enough you may be eligible to receive assistance through the Medicare Safety Net. When you have out-of-hospital treatment or service that’s not bulk billed like visiting a GP, having an x-ray or an ultrasound, there will be an amount that is covered by Medicare and an amount you pay yourself. When you hit the thresholds in a calendar year, you will begin to receive a higher amount from Medicare and end up paying out less from your wallet. For families receiving Family Tax Benefit Part A, the threshold is lower than that of the general population. To ensure your family is covered by the Medicare Safety Net you need to register for it.

You should only need to do this once (and it’s only for couples/families as individuals don’t need to register) but Medicare will need to be kept up to date when new babies arrive and when your kids cease being dependents.

Lots of women, particularly those in lower paid jobs, get hit so hard from the cost of child care that they question the value of working. If your net child care costs (after the rebate) are about equal to your net income (after tax) please take heart in three things: 1) You should be getting paid superannuation so there will be some financial benefit from working for you, albeit one that you won’t see the immediate reward from; 2) From an experience and future promotion point of view it is always better to be in the workforce than out of it; and 3) You get the mental benefit of a break from the kids. Unless you are the low paid woman working at the child care centre that your kids are actually attending.

Family day care

Family day care is where you drop your child at a private house to be looked after by (usually) one person. There are a maximum number of children who the carer will be able to care for, normally a handful of kids, and they may not be able to look after small babies. The children are cared for in a home environment and the costs are generally cheaper than for child care. You will receive the Child Care Subsidy where eligible for the costs of approved family day care, and their cost, starting at around $6-8 per hour per child, will be lower on average than for child care centres. You may be required to pay a small annual membership fee for family day care and some charge a daily rate instead of an hourly fee.

The downside to family day care is that if the provider is sick they will be unable to take your child until they are well again. This doesn’t necessarily mean that you have to take the day off work to care for your child, as family day care providers are usually required to have permanent spots available at day care centres to cover these situations. But it would mean that junior finds themselves being dropped in an unfamiliar environment. As there are a number of staff at a child care centre, when one is sick, the others can take up the slack without adversely affecting the kids.

As an alternative to long day care or family day care, do a kid swap. Look after a friend’s child on one or two days of the week in exchange for them looking after yours for the same number of days. This would help returning to part-time work or study by keeping your costs right down. But looking after somebody else’s child may not help your sanity.

Pre-school (kindergarten or prep)

A photo I took back in 1993 in the grounds

of my old pre-school. It was back in the

innocent years when a young unemployed

guy wanting to break into photography

could walk into a pre-school playground

and ask the staff if he could take some

photos to enter into a competition, without

the pre-school staff ringing the police.

In NSW, pre-school is what you attend before you go to kindergarten (the first year of school), while it is the reverse in Queensland. In WA you go to kindergarten then pre-primary, and if you grew up in the NT, you may have attended transition while SA has reception and Victoria’s first year of school is called prep. Simple. To make it easy, I’m calling it pre-school.

What I’m talking about here is non-compulsory care that incorporates some education, possibly delivered at a location separate to a school. Just as the name of it differs around the country, so does the service. Pre-schools are generally only for the year before a child starts school (around four years of age, two years before Year 1), and are open for limited hours, 10-15 hours per week is not uncommon.

There are two types of pre-school providers – public and private, and, just as with health insurance and schooling, private is more expensive than public. Public pre-schools may require only a voluntary, tax deductible contribution, while private pre-schools can cost several thousands of dollars per year.

Nannies

Despite what we’re lead to believe from the telly, a nanny doesn’t have to be a bespectacled British woman who has a thing for purple jackets, an American woman with the world’s most annoying voice, or a middle aged man dressed up as an ageing Scottish lady.

A nanny is typically a female aged anywhere between 20 and 60 who comes to your home for what is, basically, regular extended babysitting. They can charge anything from $20-$30 per hour per family but will usually cost you extra for things like superannuation, domestic worker’s compensation insurance and agency fees. A nanny is best suited for situations where the children need looking after for a couple of hours a day, like between when school finishes and when you arrive home yourself to take over.

The advantages of a nanny are that they come to your home where your child is accustomed to their surroundings. You can choose to have someone look after your child just for those hours after school/pre-school when you are still at Tafe, uni or work, rather than having to pay for a full day as you would with child care. Unless the nanny is sick and passes it onto your kids, chances are they will avoid all the lurgies that go with being surrounded by snot-nosed kids for eight hours a day at child care or family day care. And you may find that they are able to get dinner started for the family before you get home.

The drawbacks are that nannies cost more on an hourly basis than any other type of care, although the more kids you have, the more cost effective it becomes. Your children will not get the benefits of social interaction with a nanny as they would with being surrounded by other children.

Au pairs

Claudia was an au pair for Grace, Lilly, and Archie who look

like absolute angels in this photo. The camera lies.

Au pairs often get confused with nannies as they are similar. An au pair typically refers to a young woman from overseas who wants to improve her English while earning a few bucks living with an Australian family. An au pair becomes part of your family while they are looking after your kids (the term au pair is French for “on a par” or “equal to”, as in equal to another member of the family. It doesn’t mean you get two of them).

You will need to be in a position to provide food and a room, but if you can, an au pair will be quite cheap. After the once off fee to the agency of between $450 and $1,300, expect the weekly cost of an au pair to be between $150 – $450, depending on their level of experience and how many hours they are working for you. However, most will cost you around $150 – $250 a week for 30 hours work. There are even a few websites around that, for a small fee, give you access to the au pairs on their system. This allows you to contact potential candidates directly and avoid the agency fee. Like a nanny, an au pair should not cost more if you have three children to look after than it costs for one child.

One of the wonderful advantages that comes with having an au pair is the cultural experience. Not only do you as a parent get to learn about another culture, but your children may even be exposed to learning a few words of French, German, Korean, Spanish or a bunch of other languages. Quite often your family ends up with a friend for life.

The drawbacks of an au pair include needing to have a spare room for them and the loss of privacy that comes with welcoming someone into your home. You will also not receive the Child Care Subsidy (see below) for costs associated with an au pair. As au pairs are generally not qualified in looking after kids it is very hit and miss as to how good your au pair will be. Some are absolutely wonderful and worth their weight in gold while others are bloody woeful. Claudia and I had three au pairs look after our girls one year when Claudia was studying and we experienced the full range of competencies.

Government Payments

There are a bunch of government payments for families including Family Tax Benefits, Child Care Subsidy and Parenting Payment.

Family Tax Benefits

Family Tax Benefits are payments made from the federal government through Services Australia to eligible families. The payments come in two parts – Part A and Part B.

Family Tax Benefit Part A is paid to families with dependent children/students aged up to 19. There are a number of boxes that need to be ticked before you can receive this payment, particularly for those in the student category, including passing the rather complicated income test. This Services Australia page shows the cut off income amounts for families.

The payment is up to about $248 per fortnight, however, young people who are homeless, refugees or have a disability and who are in an approved care organisation may receive significantly more.

Family Tax Benefit Part B is for single parent families and families who have one main breadwinner earning under about $100,000 a year. Your child must be aged up to 16, or from 16 to 18 and still studying.

If your youngest child is aged under 5, you will receive a maximum of $162 per fortnight, if your youngest is aged between 5 and 18, you receive a maximum payment of $113/fortnight. You may also be eligible to receive a supplement. For more information on both Family Tax Benefit Part A and B, check out the Services Australia site.

Child Care Subsidy

The Child Care Subsidy is the main way the federal government assists families with child care fees. To be eligible you must have a family income less than $530,000, and have a child 13 years or under who is not at secondary school (unless they have conditions such as a disability). The payment is up to 90% of the cost of child care, depending on your income. Unlike the old system where the money was paid to the family, the new system’s payments are paid to the child care provider. Your child can have a maximum of 42 days absent before the govt stops subsidising or requests evidence to prove they have a specific reason for not being in care. Forty two days goes real quick when you take out a few weeks for family holidays and all the time they can spend crook so it’s a good idea to ask your doctor for medical certificates to give to your child care centre when they are sick. To receive this payment for child care, the place you send your child must be approved. More details are available on the Services Australia Child Care Subsidy page.

Immunisation hurts. Pertussis kills.

Do the maths.

To receive the Child Care Subsidy, you need to make sure that you have your kid’s vaccinations up to date otherwise you won’t be eligible it. As a parent who is firmly on the science side (i.e. the side of credible, peer reviewed articles in credible journals), I’m very happy with changes to laws covering vaccinations that once allowed parents to be conscientious objectors to their children receiving vaccinations, yet were still eligible to receive the government benefits that are designed to boost immunisation levels. Now, a child needs to be fully immunised or have a valid medical reason not to be. I don’t think parental stupidity counts as a valid medical reason.

Parenting Payment

The Parenting Payment is an income and assets tested amount paid to single parents with a child under 14, or partnered parents with a child under 6. It’s the main income support payment while you’re a young child’s main carer. The maximum amount paid for single parents is $970 per fortnight, or $686 for partnered parents. For more information and to make a claim, visit yet another page at the Services Australia website.

Centrelink’s online estimators can show you how much money you can expect to get for Parental Leave Pay, Family Tax Benefits, Child Care Subsidy and a couple of others. For a federal government site it’s surprisingly easy to use once you sign in to myGov.

Next Sub-topic: The Later Years (6-18)>>