Disclaimer

This course is not financial product advice, it is information only. Before acting on any of this information you should consider its appropriateness to your situation. The course does not take into account your individual objectives, financial situation or needs and, as such, should not be taken to be a personal recommendation.

References to external websites are provided for your convenience and do not constitute endorsement of the information at those sites or any associated organisation, product or service. The author accepts no responsibility for the accuracy, completeness or currency of material contained on any external website referred to in this course.

The information contained in the course is taken from sources that are believed to be correct at the time of writing. The author accepts no liability of any kind to any person who relies on the information contained in this course.

Now that you have read this disclaimer, don’t bother clicking on the ‘I Agree’ button below. Just hit the X in the top right-hand corner, or click anywhere in the grey border to close this message.

I Agree!

You didn’t read the disclaimer properly, did you? Back you go and read it!

Warning!

The following information contains mild coarse language and some sexual references, which may offend some readers.

But probably only the knobs.

Financial Freedom for Gens X and Y by Nick Haggarty

Introduction

G’day and welcome to Financial Freedom for Gens X and Y. This course is designed to give you the information about money you wish you’d been taught at school – the sort of stuff that should see you out of debt and sleeping well at night, with money not being a worry for you. If you reckon I’m gonna teach you how to retire as a millionaire by age 40, it’s time for a reality check. For the vast majority of us, that’s simply not possible.

What I teach is how not to be at the mercy of a bank for 25 years with a mortgage that drowns you, and how to set up your super so that you can retire comfortably when you reach normal retirement age. I’ll tell you what to avoid and how to avoid it, as well as how you can get your money working for you, and where to find some really great info (‘cause I don’t have all the answers). And I’ll do it in language you can understand.

So if you thought I was about to divulge to you the secret of money, revealing how to work out next week’s Lotto numbers by factoring in where Jupiter is in relation to Mercury’s second-largest moon, then you’re a dickhead. Mercury has no moons.

The Hon Philip Ruddock, arguably the world’s most boring man.

If you feared that learning about money was going to be as dry as listening to former federal politician Phillip Ruddock talking about, well, anything, then think again. This course was written with the average attention span of a YouTube addict in mind. Almost all of the videos run under four minutes and most are funny.*

*I reckon they are. I don’t care if you think they are or not. Good on you for reading the fine print as you have just learnt your first lesson in finance – always read the fine print.

Mum and Dad.

Before I outline the topics you will be learning about, let me tell you a bit about myself. (Skip this bit if you don’t like self-indulgence, or couldn’t care less if I have any credibility or not.)

I’m a gen X-er, born in the mid 70’s, and extremely lucky enough to grow up with two parents who were pretty bloody good with money. Most of the world’s kids don’t have this luck and aren’t born in Australia – one of the world’s richest countries.

Let’s all take a moment and stand for a moving rendition of the national anthem.

But don’t bother with the no-longer-sung 4th verse:

Shou’d foreign foe e’er sight our coast,

Or dare a foot to land,

We’ll rouse to arms like sires of yore

To guard our native strand;

Brittannia then shall surely know,

Beyond wide ocean’s roll,

Her sons in fair Australia’s land

Still keep a British soul.

In joyful strains then let us sing

“Advance Australia fair!”

My ever-expanding bald spot.

The only thing British about my soul is the fact that I can’t stand outside on a 25+ degree day for more than six and a half minutes without ending up with a burnt bald spot.

Apart from being as white as snow, I really am bloody lucky to have had the background that I’ve had. I started investing in managed funds when I was 21, and went to a few investment seminars where I realised I was the youngest person in the room. My interest in money got to the point where I decided to do a Diploma of Financial Planning through Deakin University. When I finished it, I was enjoying my non-finance related job enough to remain out of the finance industry.

But, I was still the youngest person at the investment seminars.

At one seminar I thought to myself “Why are all the people here asking questions about what their sons and daughters should be doing with their money? Why aren’t their 20 year old daughters and 30 year old sons here, asking the questions themselves?”

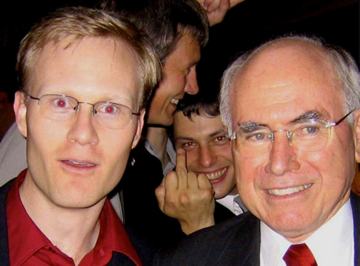

The former member for Berowra

You see, your average financial seminar is as boring as the former honourable member for Berowra. A suit-wearing guy standing in front of an audience and talking about money in the most deadpan way possible is hardly what keeps people coming back for more. So I thought that I should write and present a course myself. Five years of face-to-face courses later and it evolved into the form you are reading today.

I am not a boring financial planner. Nor am I an investment advisor, insurance salesperson, mortgage broker, real estate agent, accountant or stockbroker. I am not employed in the financial services industry at all. I do not hold an Australian Financial Services Licence, nor am I an Authorised Representative of a licence holder. I’m a TV cameraman based at Parliament House in Canberra. You’re probably now thinking, “Great. I’m wasting my time on this course.”

To make you feel better, here is a photo of me at work.

Here is an old photo of me and a cheeky colleague.

And this is a photo of me wishing I was talking to Phillip Ruddock.

No, those images have not been Photoshopped. Now you really are thinking, “Definitely wasting my time!”

The diploma I gained used to be the standard qualification for financial planners working in the industry. These days planners should have a degree in financial planning. So, apart from holding a sub-standard diploma, what sets me apart from your average financial planner, yet still sees me able to teach you about basic finance?

Two things.

Claudia, possibly drunk.

Firstly, I’m independent. I am not attached to any financial company or institution and I am not obliged to push any products or services. However, I will point out services of organisations and companies that I believe to be of a very high standard, and many of these are independent themselves (or government run). Most of the things I will teach you about I have personal experience with.

My first place.

Secondly, I am debt free. My wife, Claudia, and I have no ongoing credit card debt (we have one credit card which we pay off in full every month), no personal loans, no car loan (I drive a 2021 model Hyundai, Claudia has a 2019 Mitsubishi) and no mortgage. I used to own a three bedroom townhouse in a northern Canberra suburb, outright. Several years ago I sold it and used the proceeds to purchase a more expensive townhouse closer to work in central Canberra, with a small mortgage. Claudia and I paid it off in 2008. In 2011 we moved into a house on a large block, again in Canberra, and started another small mortgage which we paid off in 2014. This is despite dropping back to one income when Claudia gave birth to our first child in early 2011, a second bub arriving in 2012 and Claudia completing a (non-HECS/HELP) degree in 2013. To date it’s the 4th mortgage I’ve kissed goodbye to.

Townhouse two.

I basically got to where I am today by practising what I preach – putting into practice the information presented in this website (and yes, it certainly helped having a wife who is also very good with money).

My friends describe me as lots of things, including a tight-arse, boring and a nerd. It is not up to me to judge myself (as John Howard used to say, “The people will judge me” – and they did, John, as only the second sitting PM to lose your seat), but I will tell you that one of my hobbies is collecting playing cards from around the world.

Before you say anything, I do NOT know how to solve a Rubik’s cube.

I particularly go for packs with 52 different scenes or sayings, and my favourite is a British pack that takes the piss, titled ‘52 Ways to Become a Millionaire’. I’ll share a few of them with you from time to time, like the ace of diamonds there on the right.

Guru Clitheroe

I will probably teach you things about money that differ from what you may have learnt previously. For example, many people believe that an investment property is the best investment anyone could ever have. As you will see over the duration of the course, I don’t agree with this. If I do write something that’s different from what you think, please take on board what I have to say because there are many misconceptions surrounding money. The Australian financial guru Paul Clitheroe estimated that the average Aussie throws away about half a million dollars over their lifetime because of a lack of basic financial literacy.

FURTHER READING: Making Money: The Keys to Financial Success (Penguin books) by Paul Clitheroe: best known for his Money programme, which used to run on Channel Nine.

FURTHER READING: Making Money: The Keys to Financial Success (Penguin books) by Paul Clitheroe: best known for his Money programme, which used to run on Channel Nine.We tend to learn about money from two sources, neither of which for gen X-ers and older gen Ys is school: 1) our family of origin; and 2) self education. If you learnt about money from your family and they always struggled to get by, there is a big chance you are in the same situation. If this is the case, then take comfort in the fact that you are now in the smaller category of those who actively seek to educate themselves about the basics of money. In the meantime, don’t feel as though you are the only person in the country who has experienced some of the more nasty things I mention, I assure you, you’re not alone.

Please feel free to hit me up with any questions you may have at any time. But please understand that, as I do not know everything about your individual circumstances, I cannot give personalised advice. The information I give is of a general nature only. Please read the disclaimer right at the very start of this introduction. You may need to refresh your page to get it back up again.

Read it? Good. Now you can’t sue me.

Having said that, if you throw a hypothetical at me about a friend’s finances perhaps, then I can tell you what I reckon your friend should do but I can’t tell you what you should do.

Please remember that there is no such thing as a stupid question. If you don’t understand something, it’s not because you lack intelligence. It’s because I haven’t taught you properly. Wish I’d known that at school. In year 11 maths, with the teacher leaning over me saying, “Why can’t you understand this, Nicholas?” what I should’ve said was: “Because you’re a really crap teacher, Miss. And you smell like a man.”

The topics in Financial Freedom for Gens X and Y are:

- Gambling

- Goal Setting

- Debt Elimination

- Saving

- Budgeting

- Investments

- Taxation

- Superannuation

- Insurance

- Estate Planning

- Financial Planners

- Kids And Money

The Debt Elimination topic is a long one, so I have broken it down into the following sub-topics:

- Pawnbroker And Payday Loans

- Store Credit

- Store Cards

- Credit Cards

- Personal Loans

- Car Loans

- Mortgages 1

- Mortgages 2

- HELP

The Kids And Money topic is also a big one and is broken down into the following sub-topics:

- Kids And Money Introduction

- Getting Pregnant

- Being Pregnant

- Hello Baby!

- The Early Years (0-5)

- The Later Years (6-18)

The topics are arranged so that they are covered in order of importance for people who are the most screwed financially. Please don’t skip any topics or complete them out of order, because the knowledge from an earlier topic is often used in a later one. This is especially the case for the Kids And Money topic as it includes information on investment, taxation, super, insurance and a bunch of other money stuff as it relates to children.

There is not a huge amount of detail on most of these topics. Rather, what I do is introduce you to the basic concepts you need to know to keep you out of trouble. If you need lots of detail then check out the many books and links to external websites throughout. These are also listed under the ‘Resources’ tab. (Where there is no ‘Resources’ tab, there are no resources for that sub-topic. Or I’ve stuffed up and need to call my web guys.)