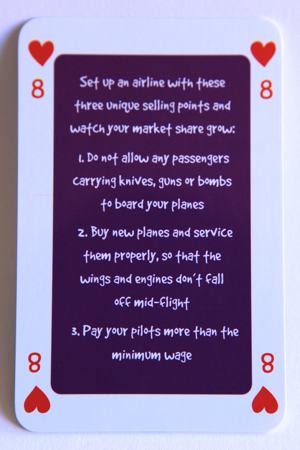

Insurance

Not having insurance is riskier than any investment.

To ensure you are all right in a worst case scenario you need to have insurance. Insurances can be broken down into two groups: insurances to protect your belongings, and insurances to protect yourself. You can get by without having any insurance at all, but if disaster strikes you would be paying for it, and regretting it, for many years to come.

Building and contents insurance

Anyone who was living in Australia over the 2019/20 summer should need little reminding of the value of building and contents insurance. It is essential. (For those who need reminding, that was the summer that bushfires raged for months, killed many people and destroyed over 3,500 homes.) Too many people that summer not only saw the fires completely devastate their houses, but also realised too late that they could’ve covered themselves with building and contents insurance. Many more discovered when they went to make a claim that they were underinsured – the payout received from the insurance company was nowhere near enough to cover the costs of rebuilding. The same situation hit householders in Queensland and New South Wales after the myriad flooding events of the past few years.

It is not up to the insurance company to make sure you are not underinsured, it’s the customer’s responsibility to make sure the insurance accurately reflects the cost of the contents and rebuilding. There are few insurance companies who offer total replacement cover which will guarantee to pay the full cost of rebuilding your home no matter how much you are insured for – make sure your insurer is one of them. If you have no idea what amounts you need to be insuring your assets or yourself for, you need the help of an insurance broker. They help with recommending specific policies as well.

With contents insurance you are best going for a ‘new for old’ replacement home contents policy. Some cheaper policies will only cover you for the second hand value of your contents, leaving you potentially thousands of dollars worse off if you lost the lot.

If you are living in share accommodation you may have looked for contents insurance and had no success finding a company who will cover you. Insurance companies largely steer clear of share houses where the people living together are not related or have not known each other (or lived together) for 12 months or longer. If you are living in a share house and you have paid for contents insurance, just check that your insurer knows about your living arrangements, otherwise you may be paying for a policy that wouldn’t be paid out in the event of a claim.

If you own an investment property you should have landlord insurance on that property. If your previous tenants absolutely trash the place, this insurance pays you the cost of repairs and lost rent while you have tradies in to fix the damage.

You need to know that with all types of insurances, different companies cover different events. For example, some companies will cover you against flood damage for a home and contents policy, others won’t. This is particularly pertinent for those who live in or near flood prone areas, even those whose house has not become flooded in the past. As natural disasters increase in frequency and damage due to the effects of climate change, insurers cover less and charge more.

OK, so you’ve sorted your building and contents insurance then packed your bags, grabbed the keys, and jumped in the car. What happens if you have a car accident that is your fault on the way to the airport?

Car insurance

As your car is registered, your compulsory third party insurance (which you have to pay as part of your rego) will cover injury to people other than yourself. If your car is worth next to nothing, you may opt for third party property insurance. This will cover any damage you cause to any property other than your own car. There is a variation on this policy type called third party property, fire and theft insurance which covers your car for a total loss if it is stolen or lost to fire, as well as damage you may cause to another person’s property. If your car is worth insuring fully, then a comprehensive car insurance policy will cover damage done to your car as well, even if you don’t know who caused it. Naturally this cover is the most expensive.

Car insurance is more expensive for groups that have the greatest number of claims. As so many younger drivers have accidents, especially males, the older you get the cheaper your insurance gets. But, if you have accidents which are your fault, the next time you pay your premium you will pay more. Some insurance companies offer a guaranteed cheaper premium for life if you have no at fault claims for a certain number of years. Then you have kids, who become teenagers, get their licences and you’re back to paying heaps for car insurance again.

Please don’t ever be tempted to drive an unregistered car or ride an unregistered motorbike. Not only do you face being hit with a fine (‘cause it’s illegal) but if you run up the arse of a new E-Class Merc you are liable for the cost of repairs as well as medical costs of the occupants where you have been the cause of their injuries. Yes, even if you have comprehensive insurance. There are clauses in insurance contracts that say if the vehicle is unregistered then your insurance is invalid. Likewise if you were breaking the law at the time of the accident.

Travel insurance

After your bingle you jump on the plane and fly to Queensland’s Gold Coast and before you know it you’re doing some rock fishing. Everything is going fine until suddenly an unexpected big wave hits and sweeps you into the sea and the next thing you remember is waking to the sound of the rescue helicopter taking you to hospital in Brisbane. You can’t feel anything below your neck and you’re quite worried.

There is no need to worry though because your travel insurance has covered the cancellation of accommodation for the rest of the trip, and you’ll get a replacement camera for the one that was slung over your shoulder when the wave hit. If you had decided to go rock fishing overseas, your travel insurance would cover your medical costs as well, but if you are traveling domestically you need a separate health insurance policy if you do not want to rely on Medicare. For more on Medicare take a look at The Services Australia website.

Holders of some types of credit cards may find they have travel insurance provided at no extra charge. The reason for this is to encourage you to go on a holiday and pay for it with the credit card, spend too much money and pay the credit card company lots of interest. Generally they are also not very good policies, so you may well be better off purchasing your travel insurance separately. You may also have to put the entire holiday on the credit card to receive the insurance, not just the airfares. Some insurance policies offered via credit cards are adequate, but a lot of them are crap.

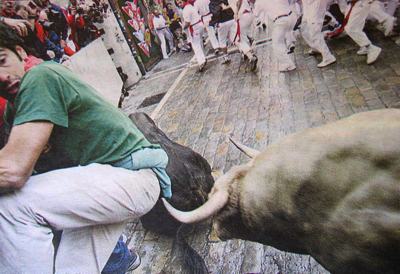

It’s about now that you’d regret holidaying

in Pamplona.

I read a quote once from a spokesperson from American Express talking about how good the insurance coverage attached to their cards was: “My view is that unless you are doing some sort of extreme sports then we’ll cover you,” he said. Read the fine print and you might find that extreme sports are skiing, snowboarding and that once in a lifetime bungee jump in New Zealand that you do with your mates.

If you can’t afford travel insurance, you can’t afford to travel because it’s as vital as your passport. Travel to the US without travel insurance, have an accident that sees you requiring treatment then transport back home, and you could be out of pocket by $250,000+.

Health insurance

The emergency chopper ride to the hospital is free, thanks to your private health insurance. Cheap levels of health insurance will only cover accidents and emergency situations, while the more expensive levels cover things like heart bypass surgery and all the rehabilitation you need to get back on your feet. Most levels of private health insurance provide for ambulance cover including by road or air.

It is important to know that a lack of health insurance, or lack of the right amount of health insurance, will cost you if you are likely to be hit with the Medicare Levy Surcharge. This is an extra 1-1.5% tax that individuals who earn over $93,000, or couples who earn over $186,000 a year start to pay if they do not have private health insurance with hospital cover. These dollar amounts rise by $1,500 for every child you have after the first. The table below shows the income amounts where the Medicare Levy Surcharge kicks in for those without private health insurance. You also need to ensure your policy has an excess for any claims of not more than $500 for one person and $1,000 for couples/families, otherwise you still have to pay the extra tax.

Medicare Levy Surcharge until 30 June 2024

| Singles | Under $93,000 | $93,001-$108,000 | $108,001-$144,000 | Above $144,000 |

|---|---|---|---|---|

| Couples / Families | Under $186,000 | $186,001-$216,000 | $216,001-$288,000 | Above $288,000 |

| Medicare Levy Surcharge | 0 | 1% | 1.25% | 1.5% |

If you’re not sure what your income for calculating the surcharge is, let the ATO’s income for surcharge purposes calculator do the work for you.

Health insurance can be split into two main areas: 1) hospital cover; and 2) ancillaries (extras) cover. Policies can be one or the other, or combined. No prizes for guessing what hospital cover is for. Ancillaries cover is for things like dental, optical and physio – all those things that you would get outside a hospital.

If you wait until after your 31st birthday to take out private health insurance you will pay an extra 2% premium for each year you are above 30 (an extra 2% for a 31 year old, 4% for a 32 year old, 6% for a 33 year old – I think you can see the pattern emerging there). Health insurance involves the old carrot and stick approach by the federal government. The carrot is – “Look at this juicy 24%* rebate we give you on your annual premium. Mmm, yummy!” The stick is – “You are too old and rich not to have health insurance. Buy it or we’ll hit you hard.”

* The federal government lowers the private health insurance rebate from 24.608% to 0%, depending on your income. The table below shows the income amounts for individuals and couples/families aged under 65.

Private Health Insurance Rebate from 1 July 2023

Singles Under $93,000 $93,001 – $108,000 $108,001 – $144,000 Above $144,000 Couples/ Families Under $186,000 $186,001 – $216,000 $216,001 – $288,000 Above $288,000 Rebate 24.608% 16.405% 8.202% zero

If you don’t have health insurance and you need to go to hospital in Australia you will still receive (largely free) treatment under one of the best health systems in the world. Because our public health system is relatively good, many Aussies say “Why would I want to spend thousands on health insurance?” There is an argument for what’s known as self-insurance, basically meaning you save what you would’ve spent on health insurance premiums and use those savings to pay for any treatment you need, when you need it. Three things must be said here: 1) It requires discipline to not spend the savings on new shoes and haircuts; 2) You have to make sure you don’t get terribly sick or badly injured (unless it happens inside a federal government building); and 3) If you are going to get moderately sick or injured, make sure you time it so that it only happens after you have saved up enough. Some people successfully self-insure, and good luck to them. Let’s face it, they’re gonna need it.

Hey Nick, where’s your links to iSelect and Compare the Market? There are a bunch of websites that allow you to search their databases for health, car and life insurance policies, as well as home loans. However, their databases are only made up of “participating funds”. If you use iSelect for health insurance, for example, you will not be recommended any funds from Bupa or Medibank Private, companies which have scored highly in Choice reviews. You will be much better off going to Choice insurance reviews instead. Spending a couple of bucks to sign up for access to this article is worth it for a better value policy. Or do the legwork yourself by entering your requirements into PrivateHealth.gov.au‘s page to compare policies. Even if you are happy with your current health fund, you might find a better and cheaper one with this search.

If the annual increase in your private health insurance premium makes you want to spew (’cause it is always higher than the inflation rate) you can pre-pay a year or more worth of premiums in March, if your fund allows you to. Why March? Because premiums for health insurance all go up in April.

Back in the Brisbane hospital, the first doctor you see tells you that you’re paralysed from the neck down, for life. You have the most expensive health insurance which includes top hospital cover as a private patient in a private hospital, or private room of a public hospital, your choice of doctor and no waiting periods (subject to the conditions in the fine print). So you exercise your right to demand to be seen by the best doctor available.

Total and permanent disability insurance

While you are waiting to see them you’re glad you renewed your total and permanent disability insurance, which pays a lump sum in situations like yours. At least now you will be able to afford ramps to be installed at home for your new motorised wheelchair. This insurance is also designed to pay off any debts you may have and cover your new carer’s wages and other costs associated with your disability.

Income protection insurance

The top doctor tells you some mixed news. The good news is you have pinched a few nerves and in a couple of days you will be able to move your arms and legs. Bad news is your neck is broken which will require 15 weeks off work for you to recover. The sick leave you have accumulated sees you through the next four weeks at which stage your income protection insurance starts paying up to 85% of your normal wage (or even more with some policies) until you return to work.

The premiums for income protection insurance are tax deductible and the policies become cheaper the longer the waiting period you decide to have. The amount you can expect to pay varies greatly with your age, sex, whether you smoke and most importantly your job and current income, but, as with all insurances, shop around for the best deals.

The longest waiting period you will find for income protection insurance is two years (it’ll be the one with the lowest premium). Having such a long waiting period will only work well for you if you have a massive amount in savings or a separate income protection cover through your super fund, which itself is unlikely to last longer than two years. So, you get injured or sick and start claiming on the superannuation income protection policy, then if you are still sick when it expires, your policy held outside of super kicks in and covers you until retirement. But if the period where the two insurance premiums would pay out overlaps you won’t get the full benefit from both.

I always think it’s strange that we’re far more likely to insure our houses than our income that pays for the house.

If you’re a single person and don’t live with your family, losing your ability to earn an income will mean having to rely on the Disability Support Pension which is not much more than a maximum of $1000 per fortnight. If your independence is important to you, get income protection insurance. If you’re the parent of an adult child, pay your offspring’s policy for them, if you don’t want them moving back home with you.

You might be reading this thinking to yourself that the story I have made up about having a broken neck is a bit far fetched or that it won’t happen to you. I’d like to point out the person with the broken neck in the photo on the right is a friend of mine. She sustained her injuries in a car accident, which she suffered after I had written the hypothetical story above. She was in the passenger seat when the unknown driver of an oncoming car decided to play chicken. Her neck was broken by the airbag which went off after the driver of her car took the option of swerving and unfortunately ploughed into a tree. Sometimes really bad things can happen to really good people, and change their lives in an instant.

Life insurance

Fifteen weeks later, as you are crossing the road on your first day back at work, you are hit by a bus and go into a coma. Two weeks later you die, never having regained consciousness. Unfortunately there is one area where you have not insured yourself to the amount you should have – life insurance. The small amount of life insurance you had with your super fund is only just enough to cover your funeral costs and provide for your two dependent children for 12 months. This is not a good situation as it means the kids, and whoever now raises them, will suffer financially. If you had taken out a separate life insurance policy, this could’ve seen your kids looked after until they were old enough to look after themselves.

Life insurance premiums differ greatly depending on how you have purchased it. According to Canstar, life insurance is cheapest when purchased through your superannuation fund. Next cheapest is insurance bought through an adviser, despite hefty commissions paid to them, and the most expensive is where you contact the insurer directly over the phone or online. So get as much as you can through your superannuation fund before looking to top it up outside super.

A great way to pay less for your insurance is by getting back part of the commissions you would be paying. YourShare is a cash rebate broker that can get money back into your pocket from total and permanent disability, income protection, trauma and life insurances.

The type of cover you get through superannuation is life insurance, total and permanent disability insurance and/or income protection insurance and for some of you it may be enough. But once you have a mortgage, partner and kids it will always need to be supplemented with insurance outside of super. The amount of insurance you would be told that you need by someone employed in the life insurance industry might be a figure that easily hits the $1 million mark or more. To get a bit of an idea, punch your figures into Canstar’s life insurance calculator.

The premiums that you pay for some life insurances (outside of super) will give you the option to pay a stepped or level premium. Level premiums cost you the same in the year you take out the insurance as they do many years later (although they do rise slowly in line with inflation). Stepped premiums cost very little in the early years then rise dramatically later on. In fact, they become so expensive that most people could not afford to pay them 30 or 40 years after taking out the policy. So which is the best premium to get? As level premiums are much more expensive in the early years than their stepped brothers, level premiums are likely to scare you off getting cover. I reckon you should consider getting the cheaper stepped premium.

Using the above example where you need to provide cover for two kids ’til they are old enough to fend for themselves, it makes sense that the lump sum you need to feed and clothe your offspring will reduce every birthday they have (as they will be another year older and closer to being independent from you). You should also be reducing your debt and increasing your assets every year – another reason why, as the years go by, you will likely have less need to insure yourself for a large amount. This means that you may be able to re-calculate how much life insurance you need every year or two, then negotiate a reduced amount of cover and premium with your insurer. Twenty or thirty years down the track, just as your stepped premiums would be going up to unaffordable amounts, you may not need any life insurance at all. You just need to be aware that if you reduce your cover, then your circumstances change, your chances of being able to increase your cover with that insurer are bugger all.

The example that we’ve looked at in this topic with the car accident on the way to the airport then the hospital stay has obviously been extreme. But it does illustrate the dangers of rock fishing and buses, and how insurance in its many forms can cover you against financial loss and hardship in many scenarios.

Other insurances

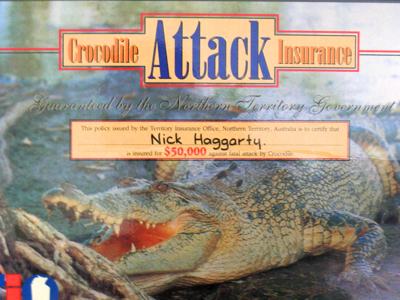

There are many other types of insurance, some of which are not worth the paper they are written on. These include: mobile phone insurance – covering lost, stolen or accidentally damaged phones and costing up to $240 per year, pet insurance – designed to cover the vet’s bills and costs up to $1,300/year (people, if your cat’s broken it’s cheaper to buy a new one, if your dog’s broken spend as much as you can to fix it), and my favourite – crocodile attack insurance. For a low, once off premium of just $10 your estate is paid $50,000 upon your death from a croc attack in the Northern Territory.

Whoa! Have a look at this little beauty!

Crickey! I’m covered against croc attacks! The Territory Insurance Office even laminated it for me for free. Best 10 bucks I have ever spent. I don’t think you can get stingray attack insurance. Sorry Steve.

The insurance premium costs of being fully covered against everything can be enormous. You need to weigh up the risks you face (crocodiles are VERY dangerous) and their potential costs, with the costs of insuring yourself.

If you have people who are dependent on you, such as a spouse, child or parent, you must consider how they will be provided for if you die prematurely or you’re unable to earn a living. At the very least you should ensure you have third party property insurance for your vehicle, and building and contents insurance for your home. And as your greatest asset is your ability to earn an income, you should seriously consider protecting it with income protection insurance.

Insurance Questions

1) The insurance policy you need to sign up for as soon as you can is:

- Life insurance

- Health insurance

- Income protection

- All of the above

- The insurance that, if you don’t have it, exposes you to the greatest loss.

2) You are single, fit and healthy, have no dependents and about 12 grand’s worth of possessions. This includes clothing, a phone, a TV and a 2nd hand motor scooter. You live in Darwin, near the harbour, where someone was recently abducted. What is the most important insurance for your situation?

- Third party property insurance for the scooter

- Comprehensive motor insurance for the scooter

- Contents insurance

- Crocodile attack insurance

- Kidnap and ransom/extortion insurance (yes, it’s real)

- The one insurance that exposes you to the greatest loss by not having it is third party property. If your transport was worth more, then comprehensive would be called for. Ps If you ride a motorbike of any kind, please get health insurance because they are as dangerous as they are fun.