Personal Loans

There are two types of personal loan: secured and unsecured. With secured loans, an item (or more than one item) is used as collateral or security in the case of non-payment – usually the item being purchased e.g. a television, some furniture or whitegoods.

You may remember this old TV ad for beer.

Give that man a New. Actually, give him a bloody carton,* because he’s just managed to rip off a pawnbroker! *carton/slab/box/case. It’s funny that in European countries, the dialect and accent can change from one town to the next. But the only way to know which part of Australia someone is from is to hear them asking for a large, small or grouping of 24 beers. The only exception to this rule are people from Adelaide who can’t say words like dance properly. And Victorians who like to mispronounce Newcastle.

In the beer ad the $150 is the loan, the $10 is the interest and the ute is the collateral, which the pawnbroker lending the money can sell if the young bloke doesn’t pay the loan back (or gets so hammered drinking beer all night that he completely forgets what he did with his ute).

Unsecured loans

Unsecured loans have no collateral and are therefore riskier for the lender, so they have a higher interest rate. But just because an unsecured loan has no collateral, it does not stop the lender getting a court order to take away your property if you don’t repay the loan.

An example of an unsecured loan is consolidating the debt from a couple of credit cards or borrowing money for a holiday. Now, as far as I’m concerned, consolidating your debts together in a personal loan to pay an overall lower rate of interest is acceptable. Please don’t be embarrassed about a credit card debt that you can’t get on top of, especially if your embarrassment stops you from choosing a better option. If you decide to consolidate your debts, make sure you cut up your credit and store cards at the same time and DON’T apply for any more credit. A personal loan to consolidate credit card debt is acceptable, but getting a loan for a holiday is not acceptable.

There’s no use going on a holiday to escape the stresses of life if you are paying for it with a personal loan that adds to your stresses when you get back! A holiday is much more relaxing if you have earned it, and paid for it, first.

You must also remember that consolidating debt means taking out a loan over a longer period than all your smaller loan periods. If you don’t tackle this loan quickly, then even with the lower interest rates you could end up paying more because of that longer loan term. You get very little in life for free and this includes debt consolidation or refinancing, so watch out for substantial fees if you go with this strategy.

There are two ways of going about consolidating your debts. The expensive way is with the “help” of a debt consolidation company like GE Money or Fox Symes. I reckon it’s funny that Fox Symes boasts proudly on their website that “Fox Symes has been featured in both A Current Affair and Today Tonight.” Um, you mean like all those dodgy builders? That’s not really boosting your street cred guys. Debt consolidation companies charge craploads for doing what you can do yourself, fee free with the help of a free financial counsellor. Yes, that’s the same link as I had a few topics back, but these people are so important that it’s worth repeating.

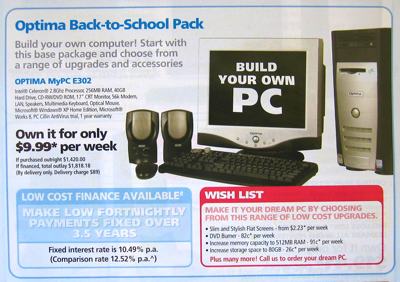

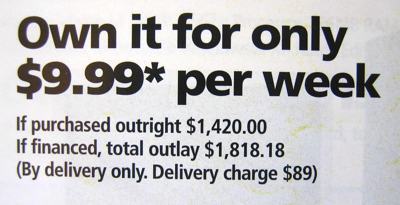

A personal loan can also be advertised as “Low cost finance. Low fortnightly payments fixed over 3.5 years” like this one for purchasing a personal computer. Read the fine print.

“If purchased outright $1,420. If financed, total outlay $1,818 (by delivery only, delivery charge $89)”. So if you use their finance you pay 28% more. The irony is that by the time you have paid it off (in 3.5 years) the computer would be worth less than the $400 extra in interest you’ve spent on it. I do not recommend purchasing a computer this way.