Mortgages 1

Mortgage – from the ancient French words meaning ‘death pledge’. A modern translation may be “I solemnly swear this thing is going to kill me!” It doesn’t have to. A mortgage is necessary for nearly everyone who buys property but the loan should be as small as possible so it can be paid off as quickly as possible.

The average gen Y, Z/millennial, can be forgiven for thinking that home ownership is something only to be dreamed of and that renting a place will be what you do for life. Let’s have a quick look at the pros and cons of buying and renting.

Buying Renting Costs more in the short term, less in the long term Costs less in the short term, more in the long term Can’t sell and move quickly and easily Can change locations with relative ease Much of the cost pays off your own mortgage The entire cost pays off someone else’s mortgage Must pay for your own maintenance and repairs Landlord pays for things that need fixing Can make minor changes to the property without permission Should get permission from the landlord for things like hanging pictures on the wall Very large set up costs, all of which are non-refundable Set up costs are usually only 4 weeks rent for the (refundable) bond Nobody can kick you out, so long as you make the mortgage repayments Can be kicked out with as little as one month’s notice Repayments can go up or down with interest rate movements Rent rarely ever falls Nothing quite like the feeling of owning your own home Renting allows greater flexibility in your life Once the mortage is paid off, housing costs are very low Costs can remain consistently high for as long as you are renting Paying off the mortgage is effectively forced savings in a growth asset Money saved from lower rental costs can be put into savings in growth assets of your choice Does that help? Probably not. The truth is, if you were to rent and save the difference between your rental costs and what you would’ve put into a mortgage, and then put these savings into growth assets over the long term, you would be financially better off. But, and it’s a big but, it takes discipline to save this way. We cover growth assets in detail in the Investment topic. And it might be unAustralian to state this because of the cultural emphasis we have on owning your own home, but there’s nothing wrong with making the decision to rent. Plenty of countries around the world have really high rates of lifelong renters compared to us, albeit with very different housing costs.

Your first home should be a first home. Was your first car a new 7 series BMW? Most likely not, so your first home should be a stepping stone – cheaper and smaller than your ideal home so you can pay it off fast. Yes I am talking about a unit, townhouse, flat or small house. With a beautiful view of your next door neighbour’s clothes line. If you can see Lake Burley Griffin, Brisbane River, Sydney Harbour, the Swan River or Hobart Harbour from the balcony of your first home, you have borrowed too much money.

Don’t start with your dream home, start with your dream mortgage because small differences in loan amounts at the start of a mortgage make huge differences to the time and interest spent paying it off. If you make lots of right decisions when you buy your first home you can set yourself up for a financially secure future, but if you make some bad ones it could set you back many years.

The average home loan in NSW grew from $110,000 in 1994 to $253,000 in 2004, then to $764,000 by 2024. I refuse to believe that this increase had nothing to do with too many people purchasing a first home that was bigger than they required. Start small, then get bigger.

Don’t be conned by the lender into borrowing too much. You want to base your borrowings on how much you feel you can afford to repay, not on the larger amount that the lender tells you you’re able to borrow. And no, you do not have to be an existing customer of a bank or other lender to get a loan with them.

When you are getting ready to buy your first home, prepare yourself for an experience filled with language and events you don’t quite understand. It goes something like this:

You look for a place and find one you like and can afford – that’s the easy part done.

You make an offer to the real estate agent to pass on to the vendor (seller).

You shit yourself because you realise you haven’t spoken to the bank about a loan.

The real estate agent contacts you to say your offer is too low.

You meet with a mortgage broker who recommends three different loans, one with a lender you’ve never heard of.

You agree to the vendor’s counter offer.

The bank you choose tells you that you have pre-approval (the thumbs up for a loan).

You pay a $1,000 holding deposit, designed to take the home off the market for the next two weeks (then hope you are not gazumped – that no one else offers a higher price).

You ring a solicitor/conveyancer to negotiate changes to the vendor’s contract for you. This should say that if you can’t get finance, the sale will not proceed and you get your deposit back.

You get pest and building reports to ensure the building complies with the regulations and isn’t riddled with termites. (In some states the vendor does this part.)

Your solicitor looks over an enormous document chock full of legal jargon. They make some changes to it (assuming the vendor’s solicitor agrees).

You sign a copy of the vendor’s contract and the vendor signs the original.

Your solicitor and the vendor’s solicitor exchange contracts and you pay a non-refundable deposit of about 10% of the purchase price.

You speak to the bank, the state/territory government overlooking the First Home Owner Grant and your mate with the ute to find out which Saturday morning they have free to help you move.

Four – six weeks later it’s time to settle. You take a bank cheque for an amount that makes your coit spasm to your solicitor. Later that day they give you the keys to your new place.

And all this assumes that things run smoothly….

If you or your partner is of indigenous descent it’s possible you will be eligible for a home loan through Indigenous Business Australia. This is a federal government program that allows low and middle income earners access to loans with lower interest rates than average lenders’ rates, as well as no requirement for paying Lenders Mortgage Insurance. As a downside, there may be waiting lists of between 6 and 12 months before you can get your mortgage. Obtaining finance through them does not affect your ability to access the First Home Owner Grant. You can get more info from Indigenous Business Australia.

A lower property price means you pay less stamp duty (the tax payable when you buy property) which means you need a smaller mortgage, which in turn equals lower Lenders Mortgage Insurance. The costs for Stamp Duty + Lenders Mortgage Insurance + legal fees + building and pest inspection costs, etc. must be separate from your home deposit savings. Expect at least $10,000 for these costs.

And unless you know for sure that the First Home Owner Grant will be available when you buy, try not to include it in your figures, but treat it as a bonus if it’s paid to you, because it’s not going to be around forever. If you are purchasing property as a couple and either one of you has owned property before, you will most likely not get the First Home Owner Grant. The amount of the grant is different across the states and territories, to find out what it is in your area visit the Federal Government’s First Home Owner Grant website.

Lenders Mortgage Insurance

I’ve mentioned Lenders Mortgage Insurance – what’s that? Lenders Mortgage Insurance (LMI) is a once off payment when you take out a mortgage based on the ratio of the loan amount to the property value. If you borrow 95% of a property’s value, expect to pay a few thousand in Lenders Mortgage Insurance, something between 2.65% and 3.3% of the amount of the loan. If you borrow 80% of a property’s value you should pay nothing for Lenders Mortgage Insurance.

Of course if you only borrow 80% of a property’s value then you must have a 20% deposit. If you reckon a 20% deposit is unthinkable, well, you’re probably looking in the wrong postcode, but consider this – my parents had to save a 33% deposit on their house as did everyone 60 odd years ago. A 20% deposit is not only do-able, it is highly desirable.

I attended a money show once; you know, those big exhibitions that are trying to get people to sign up for everything from Gold Coast property to the latest sharemarket software. And there is always one random stand with an old guy selling an amazing looking boot polish that he won’t put on your second shoe until after you’ve bought it (I always end up with one shiny shoe). Anyway, I spoke to a woman from the Commonwealth Bank’s stand who was trying to convince me that a 20% deposit is almost impossible these days. I held my tongue.

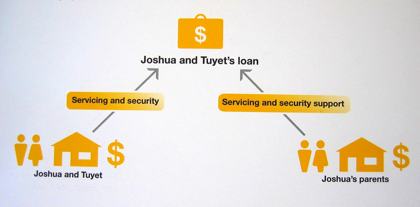

The reason she was saying this is because she was pushing this product on the left – the Family Equity Buying Solution (Family Equity BS). This is a home loan for people who have little or no deposit and wish to buy a home borrowing up to 100% of the purchase price + legal fees, stamp duty, etc. Please note that the Commonwealth Bank has stopped offering 100% home loans to borrowers with no deposit, (it took a global financial crisis for CBA to lower them, they now offer loans to a maximum of around only 90%) but other lenders still have them.

Source: Family Equity Buying Solution.

With products like the Family Equity BS, the bank holds the title on your new home as security, as well as the title on the home of a family member. If you get into trouble with the repayments a worse case scenario would see you losing your home and the family member losing theirs as well. I do not recommend this type of product.

Going into default with the mortgage repayments can be easier than you would think. Some home loan contracts have a clause stating that if you fail to pay your credit card bill it automatically puts you in default for your mortgage. Or if you are just 14 days late in making a mortgage payment, some lenders will have you in default. The lender can then demand immediate repayment of the balance of the mortgage which forces you to sell your home. Your lender will not care as much about how you would feel in this scenario as it will care about you borrowing as much money as they can squeeze from you.

If you can’t save up a deposit, I don’t know how you will pay off the mortgage and you know what – your bank doesn’t know either. That’s why they charge higher interest rates and require more insurance for higher risk borrowers.

If you are in trouble with your repayments, whether you are having difficulty repaying or you’re about to lose your house, The Mortgage Stress Handbook is a must read. It’s a publication from NSW Legal Aid, however the credit law it refers to is national and the handbook contains a stack of national and state based contacts for the other states and territories right at the end.

The more you borrow, the more Lenders Mortgage Insurance you need. Lenders Mortgage Insurance is not designed to cover you at all. In the event you can’t make the mortgage repayments, your house is sold, and the bank is out of pocket, Lenders Mortgage Insurance covers the difference. E.g. A home is bought for $600,000 with a mortgage of $575,000. Upon you making no repayments, and in a falling housing market (where prices drop) the sale price that the bank gets is $550,000.

This Monopoly player really needs to land on Free Parking.

The $25,000 difference between what you borrowed and what the bank sells your home for is covered by the Lenders Mortgage Insurance and given to the bank by the insurance company. The insurance company then chases you for that 25 grand. You have paid for the bank’s insurance policy but you are not covered yourself if things go wrong.

Cartoon courtesy of John Shakespeare.

Lenders Mortgage Insurance is one of the nastiest financial products around. Consider the situation where you have paid several thousand dollars worth of LMI on your first home, then a couple of years later you decide to refinance before you have reached the magic 20% equity in the property. As LMI is not transferable between lenders, you will pay it again. And sometimes you get hit with it a second time even if you are not going to another lender but transferring to a different product with your current bank!

If you find yourself getting into trouble with your repayments of any debt, get in touch with your lender as soon as you can to try to negotiate a suitable outcome with them. This gives you a better chance of holding on to your possessions. When you contact your lender ask to speak to the team that deals with people in financial hardship rather than some random in the call centre who is untrained, unsympathetic and unhelpful dealing with people in financial strife. The phone numbers in the following table are the financial hardship contacts for major lenders around the country.

| Lender | Hardship Contact Number |

| ANZ | 1800 252 845 |

| Bank of Queensland | 1800 079 866 |

| Bank of SA | 1800 679 461 |

| Bendigo/Adelaide Bank | 1300 652 146 |

| Commonwealth Bank | 1300 720 814 |

| HSBC | 1300 555 988 |

| ING | 1300 349 166 |

| National Australia Bank | 1800 701 599 |

| St George | 1800 629 795 |

| Suncorp | 1800 225 223 |

| Westpac | 1800 067 497 |

Next Sub-topic: Mortgages 2 >>