Credit Cards

In terms of personal debt, this is the big one. In 1999, Australians collectively owed less than $14 billion on credit and charge cards. In 2004 the figure was $28.6 billion, and by mid 2018 it had grown to around $51 billion. Three quarters of that debt is accruing interest.

If you want to see what the level of Australian debt is right now (approximately) the Debt Clock has up to date information on all sorts of Aussie debt. From what I can tell, it’s scarily accurate.

Personal credit card debt is out of control in this country, partly because when you sign up for one, it is not explained to you how best to use it so you don’t pay interest. Of course, it is not in the interests of the credit card company to tell you this, but it is certainly in your interest to know how to best use them.

Since the company that signed you up for the debt won’t have explained the dos and don’ts, you can be forgiven for not spending hours reading the fine print and then consulting a lawyer to decipher it.

Some companies will try to sign you up on the spot for a credit card. This happened to me in Woolies one day when a man representing the then Woolworths banking people approached me and started asking about the rewards program on my current credit card. When I told him it had no rewards he thought he was going to make a sale. He immediately asked about my personal financial information including how much I earned and whether I had a bad credit history (this is all happening in the pasta aisle – fettuccini isn’t usually the backdrop I choose to discuss my personal financial details with complete strangers). When I answered all his questions to his satisfaction, he smiled, shook my hand and said, “Congratulations! You qualify for a Woolworths credit card and I can sign you up today!”

Hmmm. I calculated that, given what I would spend at Woolies, the rewards on this card were worth less to me than the annual fee.

After taking into account the annual fee, you need to spend up to about $200,000 on a credit card to receive $100 worth of rewards. You don’t get your rewards for free; you pay for them in the form of higher fees and/or interest rates that are incorporated into the card.

You can get flights for free with flybuys. You will need to spend between $7,000 and $70,000 to get a flight from Sydney to Canberra (without baggage), and up to $450,000 to get a fully flexible flight from the eastern states to Perth, but, yeah, it will be free, except for the flight taxes and surcharges that you will likely have to pay. The cheaper the overall card cost is to you, the lower the chance that you are receiving ‘free’ rewards.

The ultimate credit card.

Back in Woolies, I didn’t want another credit card and I certainly didn’t need another credit card. There was no mention of how to use it without paying interest or what to do if I got into financial difficulty and couldn’t pay it off. That smile quickly left the salesman’s face when I said, “I don’t make any financial decisions without first discussing it with my wife.” You don’t even need to be seeing someone, let alone married, but if you use that line it gives you time to think about the good deals and an easy way to back out of the bad ones.

At this point the salesperson might try to turn things around and ask you if your partner would like free rewards or if your partner would like interest free days etc. – the same sales pitch they’ve just used on you. Stand your ground and tell them it’s not worth your while making a financial decision without first discussing it with your other half.

It’s a salesperson’s job to make you think you need something that five minutes earlier you didn’t even know existed. If anybody wants to sign you up for something on the spot, there is a reason for that – it’s because it’s not a good deal and they don’t want to give you time to think about it. The best deals are usually available tomorrow as well.

This video below, Shutting The Gates is a short film docu-drama about techniques of salespeople, and it’s a cracker. It runs just under 15 minutes and left my jaw dropping when I read the bit right near the end about the cost of maths software.

Types of credit cards

There are many different credit cards available, and all can be divided into two categories: those with interest free periods and those without. Cards with low interest rates generally have no interest free period. I do not recommended them because you pay interest from the date of any and all purchases. Credit cards with a 55 day interest free period will probably have an annual fee of anything from $0-$450 or more and their interest rates will be higher. This is the type of credit card we’re going to look at in detail.

To compare credit cards, home loans, term deposits, savings accounts, etc. from hundreds of providers, check out Rate City.

You do not get 55 days interest free from the date of each purchase. The start of the 55 day interest free period is rather confusing, and your statement will probably not clearly show when it begins and ends (and even when you contact your bank they can’t give you a straightforward answer).

You need to start with a balance of zero dollars for the interest free period to apply. In other words, if you are paying interest and you pay all but $5 off your card and then make new purchases with it, everything you buy accrues more interest and puts you further into debt. And yes, you will pay interest on the interest you already owe.

Just like it is for store credit, if you forget to pay your card off on the 55th day and, for example, pay it off on the 57th day, you will be hit with not two days interest, but 57 days interest. That’s interest at up to 20% or more per annum. American Express introduced a system that penalised cardholders on a sliding scale for each late payment made. Miss two consecutive payments on an Amex card and your interest rate went up to 25.99% for at least the next year.

Even if the card has an interest free period and you are currently not paying any interest, you will still pay interest from the date of any cash withdrawals you make from an ATM or at the point of sale. So if you are paying with a credit card, when the person at the checkout asks “Would you like any extra cash?” the correct answer is “No thank you”. As we have just seen, if there is currently any interest accumulating on the card then you will pay interest on all further purchases. And you pay interest from the day of transfer of debt from any other credit cards. This is where you pay one card off with another card, and it’s a really bad habit to get into because it can quickly spiral out of control.

You may laugh at the cartoon on the right, fellas, but the truth is that young men have on average 28% more debt than young women. Source: ‘Did You Know?’, On the Spot magazine, issue 13.

You should not consolidate credit card debt into another credit card. You should only use a personal loan to consolidate debt. Personal loans are designed to be extinguished; credit cards are not designed the same way.

Most banks now offer zero interest for anything up to 24 months on transfers of debt from one credit card to another, while your purchases are still charged at whatever the interest rate is on the card. The way to beat the banks with these cards is to use the card once, to transfer the debt, then cut it up before you are tempted to buy anything with it. If you can be disciplined enough to use the interest free credit card for debt transfers perfectly then it might help you to get out of debt. But these cards do not address the core issue of how you got into so much debt in the first place and will only help you if you can break your spending habits.

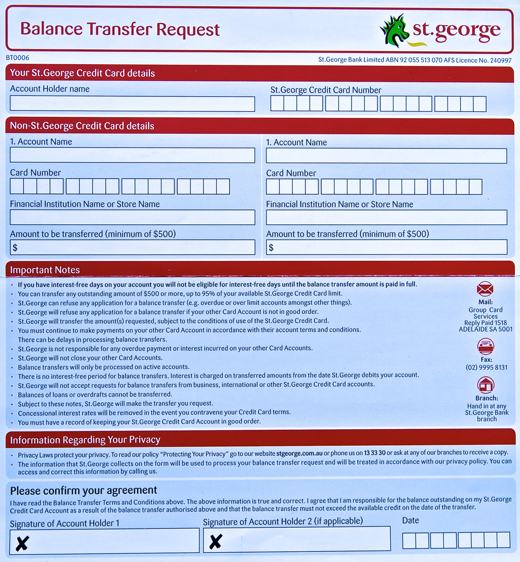

Source: St George Balance Transfer Request form.

Thinking of signing up for a balance transfer? Before you are swayed by the really big print, read the really small print. On the left: A very good reason to transfer your balance: 2.99% – wow!

On the right: A very good reason not to transfer your balance: “If you have interest-free days on your account, you will not be eligible for interest-free days until the balance transfer amount is paid in full.” Can’t see it? It’s there in the fine print under the heading ‘Important Notes’.

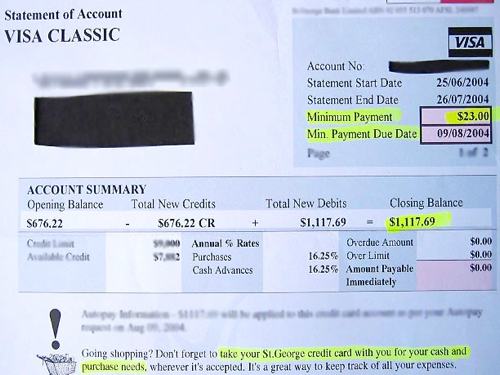

When you receive a statement, ignore the minimum payment amount. The minimum amount is there to confuse you into thinking that you can delay payment and everything will be all right. But you will pay huge amounts of interest if you only pay off the minimum amount, as it is usually just 2% of the amount you owe. Pay the total amount you owe on the statement – the closing balance (assuming you are not paying any interest). If you are paying interest, pay the total amount you owe plus any purchases made since the last transaction on the statement. In other words, get your credit card balance back to zero to reset the interest free period. If you only ever pay the minimum amount off your credit card, it is very easy to lose track of how much you are spending and continuing to rack up on credit.

On the left you can see an example of what a St George Visa Card statement used to look like. The easiest part to read is the top right-hand corner, which includes the minimum amount due. Underneath is the bit that is more important because it contains the closing balance. You can see it’s not as clear as the minimum amount – the closing balance doesn’t have its own little box, and it’s hidden in among other less important figures. Notice also what the message at the bottom says: when shopping, don’t forget to take your credit card with you for your cash needs. As it says, it is a great way to keep track of all your expenses. But there is no reminder that if you are using it for cash advances, it is also a great way to pay heaps of interest.

This picture on the right is what a St George Visa Card statement looks like now.

Thanks to some changes to legislation, credit card issuers were forced to make some adjustments to the statements. The minimum payment is not as prominent as it was. In fact, the largest print is now used for the ‘Payment Due’ – a figure consisting of the minimum payment plus any over limit and overdue amounts, which gives people a false sense of security so they pay an amount many times lower than the closing balance. However, credit card statements must now contain a warning letting customers know how long it would take them to pay off their balance if they only made the minimum repayment, then the same situation with a small amount extra every month. The law now also means you can no longer be offered automatic credit limit increases, as you can see in the message in the middle.

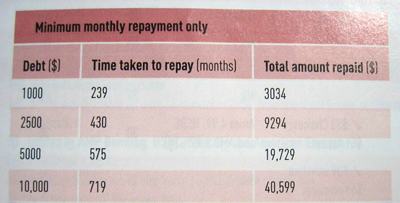

The next table on the left shows how many months it would take to repay an amount of money if you only ever paid the minimum amount due.

Source: Choice

It would take you 20 years to pay off an amount of $1,000 at the minimum rate, and 60 years to pay off ten grand. You can see from the right-hand column why the credit card company wants you to pay only the minimum. The person with a $10,000 debt ends up paying more than $30,000 in interest. The interest rate used for this table is 18.25% pa and the minimum repayment is 2% of the outstanding balance.

The lower the minimum repayment percentage, the longer it takes to pay back. For example, some credit cards have minimum repayments calculated at 1.5% of the balance. Paying only the monthly minimum in this case would see a debt of $10,000 paid back in 90 years at a cost of more than $250,000.

If you want to crunch numbers from your credit card balance to see how quickly you can pay it off, you can do so on the Australian Securities and Investments Commission MoneySmart website.

Because the interest free starting and ending dates are confusing, and because it is easy to forget to pay it off on the due date, the best way to pay off a credit card is once a month by direct debit. A direct debit is an automatic bill payment on the due date from your bank account, and it is the easiest way to pay, providing you always have the funds available in your bank. Be warned that if there are not sufficient funds in your bank account, you will be hit with bank fees.

So, ensure you always have the money set aside to cover even your largest credit card bill. This method of paying off a credit card means you will not pay interest. But if you have the funds set aside in your bank, why use a credit card at all?

The answer: convenience, the security of not carrying large amounts of cash all the time and lower bank fees when compared to multiple ATM withdrawals, as a direct debit is counted as one transaction. But if you don’t have the funds in the bank to cover the credit card purchase, don’t make the purchase.

Too many people actually do have the funds available in the bank to cover their credit card debt but choose not to pay it off in full because it will mean reducing their savings too much. They want to keep the money in the bank for a rainy day, not realising that while ever they are paying interest on their credit card, it is bloody raining.

Do not pay interest on a credit card.

And don’t pay fees on the credit card either. Fees are charged for exceeding the credit limit (but only where you have specifically agreed with your provider that your credit card can go over its limit), late payment, failure to pay the minimum amount and the annual fee. Of course, the annual fee is the only one you should be willing to pay. If you are paying interest on your card and you are hit with any of these fees, you will pay interest on those fees as well.

Fees on credit cards have been steadily increasing for a while now. 2004 was the first year when banks earned more from credit card fees than from home loan fees. Anyone who has applied for a mortgage can appreciate just how high home loan fees are.

Alternatives

There is a very good alternative to a credit card – a debit card such as a Visa debit card or MasterCard debit card. They work in essentially the same way as an ATM or EFTPOS card, and are available from most building societies, credit unions and banks. A debit card is basically an ordinary ATM card that is linked to the credit card network, which means you can make payments over the phone or internet and anywhere a Visa or MasterCard (whichever yours is) is accepted. You should not be hit with interest on purchases using one of these cards, because you are drawing straight from your own available funds.

Another advantage of debit cards is that you should not find yourself withdrawing more funds than you actually have available, although this rule may change from one bank to another. So if you only have $450 in your bank account and you try to purchase something worth $500 using a debit card, the good banks will not allow the purchase to proceed. The bad banks will let the transaction go through and then hit you with a fee for withdrawing more money than you have in your account. The good banks may not even sting you for bank fees on the transactions. Debit cards also shouldn’t attract a merchant surcharge (credit cards may attract an extra 1-2% fee on transactions), and the vast majority of them have no annual fee. As with a credit card, you can also link a debit card to your mobile to pay with your phone at the checkout rather than the the physical card. Like I said, debit cards are a very good alternative to credit cards.

What about charge cards? These are like a combination between credit and debit cards and are issued by American Express (they also issue credit cards) and Diners Club. They must be paid off in full each month. If you don’t then you are hit with a fee and can’t make any more purchases with the card until it’s cleared. Charge cards do not charge interest.

Unlike debit cards, you don’t access your own funds. Unlike credit cards, there is no spending limit (you just need to ensure you will have the money to pay it off when the balance is due). Charge cards have lower acceptance among merchants and slightly higher fees as a percentage of the goods/services bought than do credit cards. They generally appeal only to high income earners.

Far too many Australians pay interest on their credit cards when they should not. Make your purchases, pay the card off in full every month, and never pay interest. Be the kind of cardholder that Visa and MasterCard hate. That’s one who gives them only an annual fee while taking full advantage of their worldwide system. Better still, forget credit cards altogether; access your own money with a debit card and don’t pay any interest or fees.

Because I never pay interest, they hate people like me so much that they refer to us as ‘deadbeats’ (internally, of course – I never receive mail from Visa addressed, “Dear Nick Deadbeat”).

Ps In 2012, new laws came into place to better protect consumers. For holders of existing cards with an interest free period, info explaining how your interest free period works should be readily available. In theory at least.

People applying for a new credit card have the added protection of choosing their credit limit rather than just having to accept the one the lender sets. Fees for going over this limit are banned on new cards and they’ll now have to tell you when you have hit your limit. And if you have a balance attracting different interest rates (highest rate for cash withdrawals, lower rate for purchases and possibly a zero rate for balance transfers) the new laws mean that your repayments go towards paying off the highest interest rate components first. Makes total sense for consumers but I reckon the banks will just claw back lost profits through other means.

If you want to take full advantage of the new laws you have to get rid of your old credit card (issued before 1 July 2012) and apply for a new one.

Next Sub-topic: Personal Loans >>